With state imposed levy limits local governments are forced to find new ways to raise taxes. This year’s debate was about the Wheel Tax, but look what’s been happening with the Tree Tax.

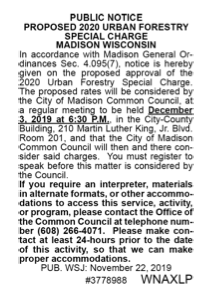

While everyone was talking about the wheel tax a notice was put in the paper that probably no one noticed:

WHY DO WE PAY A TREE TAX?

Er, Urban Forestry Special Charge. (They come up with such great names for these things.). In 2014 the City of Madison created an Urban Forestry Special Charge as a result of the Common council Alternative Revenue Work Group Report. It’s meant to cover the costs of planting, pruning and maintaining and removal of trees, stump grubbing and pest management, including dealing with the Emerald Ash Borer tree removal and treatment program. You can read more details here.

There is a separate ordinance creating the fee as well as a policy passed in 2015 about how they charge the fees. That policy was further amended in 2018 and 2018.

HOW MUCH DO YOU PAY FOR THE TREE TAX?

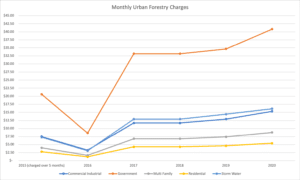

2020 will be the 5th full year the fee will be collected.

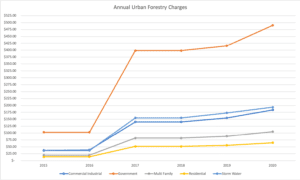

Originally in 2015 the monthly charges on our Water Bills were as follows:

Residential – $2.76

Multi Family – $3.97

Storm Water – $7.23

Commercial/Industrial – $7.47

Government – $20.61

The original FAQs said this:

The monthly rates in the table above are set to generate $1 million in net revenue to the City of Madison over the last five months of 2015. In the future, the City will collect its Urban Forestry Special Charge revenues over the course of twelve months. That is, if the Council decides to again collect $1 million in net revenues in 2016, the monthly rates will be adjusted downward by 58.3% from the rates listed in the table below to account for revenue collection being spread out over twelve months instead of five. Alternatively, if the Council decides to continue to collect urban forestry special charge revenues at the monthly rates listed in the table above, it will be on pace to collect $2.4 million over the course of twelve months in 2016.

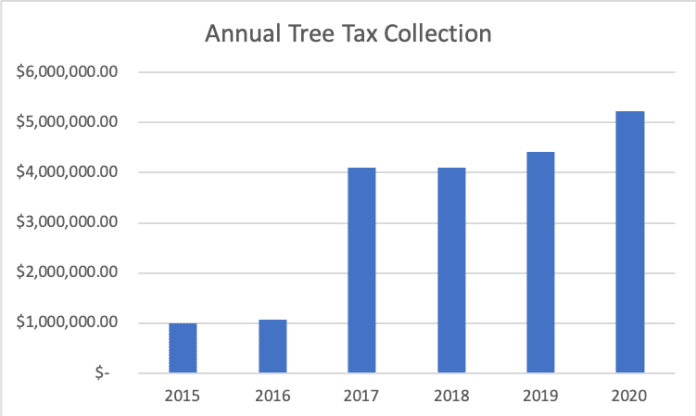

Somehow, from 2015 to 2020 it went from $1M to $5M.

2016 they collected $1,075,269

Monthly fees were as follows:

Commercial Industrial – $3.21

Government – $8.58

Multi Family – $1.65

Residential – $1.18

Storm Water – $3.03

2017 – they collected $4,099,222

Commercial Industrial – $11.70

Government – $33.17

Multi Family – $6.79

Residential – $4.27

Storm Water – $12.92

2018 – they collected $4,099,222

Commercial Industrial – $11.70

Government – $33.17

Multi Family – $6.79

Residential – $4.27

Storm Water – $12.92

2019 – they collected $4,415,842

Commercial Industrial – 12.92

Government – 34.65

Multi Family – 7.37

Residential – 4.59

Storm Water – 14.42

2020 they are collecting $5,225,341.

Commercial Industrial – $15.32

Government – $40.83

Multi Family – $8.77

Residential – $5.39

Storm Water – $16.12

Or, to put it in perspective the wheel tax is $40 per car, but we’re paying $64.68 on our water bills (2015 was collected over 5 months):

Annual

WHY BRING THIS UP NOW?

WHY BRING THIS UP NOW?

The budget is already passed, they are counting on this revenue. However, they will be discussing this tree tax at the Finance Committee meeting on Monday. If they don’t pass this, they’d have to re-open the budget, and I’m certain they won’t be doing that. This is more of a technicality at this point. I wouldn’t be surprised if this is on the consent agenda and not even discussed. However, its things like this that get lost in the budget process. It’s one little line in hundreds of pages and I’m guessing not too many people even noticed it.

BRENDA, WHY DO YOU HATE THE TREES?

Just because I chose to blog about this doesn’t mean that I hate the trees, or this particular tax. I’d rather have my taxes, no matter how collected, going for trees than other things. I just like to make sure that if we’re paying 5 times more we’re getting 5 times more service. And more importantly, that when services are needed, they don’t say we can’t do it because we don’t have any money. Often these types of taxes are a game where the local government taxes for the cost of services we are already getting, then take the money that was paying for the services (in this case services related to trees mentioned above) and dump it in to the general fund to pay for _____. In this case, probably police. They just have such a disproportional amount of the budget compared to all the other departments.

SO, WHAT ARE WE GETTING FOR TREE TAX?

The Streets Department made a special “Forestry” section of their budget and made it easy on us. The pages aren’t number, but see page 9 here for “details.”

The new section of the budget tells us this:

Service: Forestry 447

Citywide Element: Green and Resilient Service Description

This service is responsible for all forestry activities associated with maintaining Madison’s urban forest. This service is new in 2020 and reflects transferring the Forestry team from the Parks Division to Streets and combining with the stump grubbing activities performed by Streets. The goal of the service is to maintain a vibrant and thriving urban forest.

Major Budget Changes

-

-

- Transfers the budget for Stump Grubbing from Roadside Cleanup. The 2020 Executive Budget assumes the amount of time spent on activities pertaining to this service will increase resulting in additional staff time charged to the Urban Forestry Special Charge. ($782,000)

- Transfers the staff and non-personnel expenditures associated with Forestry activities from the Parks Division-Park Maintenance service. The total budget for these activities is consistent with the agency’s request. ($3.8 million)

- Based on the budgeted amounts the 2020 Urban Forestry Special Charge will be $5,159,341 an increase of $743,501 (17%) from the 2019 rate.

-

Actvities Performed by this Service

-

-

- Stump Removal: Removal of tree stumps from City property.

- Forestry Activities: Terrace tree planting, maintenance, and storm clean-up

- Emerald Ash Borer Eradication: Combats the Emerald Ash Borer through tree treatment activities.

-

What is the money spent on (According to the Executive Budget – there were no amendments)

$4,067,424 Personnel

$293,390 Non-Personnel

$842,527 Agency Charges

$5,203,341 Total

Not much detail, right? And since it’s a new area of the budget, its hard to compare to previous years to determine what we might be getting for these charges.

In 2014 before this tax it looks like they had the following expenses

Parks – Forestry – $2,911,310

Streets – ? It appears to be in the “Roadside Clean Up” budget portion – “After Forestry removes trees from City owned property, the tree stumps are removed, cleaned and filled with top soil by Streets Division crews prior to Forestry replanting a new tree.” But how much is charged there is unclear. All I can see is that they did 1,230 stumps in 2012.

TO BE CLEAR

People seem to take the information in my blogs and attribute meaning that often is not there. So, I’ll try to be crystal clear:

- The Tree Tax ($64.68/yr) costs more than a homeowner with one car paying the Wheel Tax ($40), but got very little attention.

- The annual collections of the tax between 2015 and 2020 has gone from $1M to $5M, which is a pretty hefty increase. ($64.68/yr for homeowner in 2020, up from $13.80/yr in 2015)

- The tax increased another nearly 3/4 of a million dollars this year, but it doesn’t appear we are getting a that amount worth of additional services.

- This tree tax going to change, its already in the budget that the council passed, and it likely won’t get any discussion at the Finance meeting on Monday or the council meeting on December 3rd.

- My personal hope is that whenever the Forestry Department needs something to maintain our trees, they get it. Looks like fees are being charged to replace taxes, and the money is going elsewhere in the budget. But, its hard to tell when the budget format is constantly changing.

- It would be great if the budgets were more clear and you could find out this information without having to ask staff questions. This information should be clear and transparent for the taxpayers.

- Where did the money go? What department benefited from the Tree Tax? And what did they get? Who benefits?