Well, that moved quickly! Finance Committee has an agenda item tonight that allows them to establish the fee.

I just think its absurd that they can put this agenda out on Friday at 4:30 and then meet about it Monday at 4:30. Especially on an issue as big as this. Thanks to Marsha Rummel’s weekly updates, a few people probably know this. Here’s what Marsha had to say!

Highlights: Last Tuesday Mayor Rhodes-Conway introduced her 2020 Executive Operating Budget. Agencies will make presentations at the Finance Committee on Monday and Thursday. The big news is that Mayor Satya proposes to introduce a vehicle registration fee of $40. There is enabling legislation on the Finance agenda to authorize the city to establish the fee. The vehicle registration fee would generate approximately $7.9 million annually to be used to expand Metro services in anticipation of implementing a bus rapid transit system. Last year, the Council did not support then Mayor Soglin’s proposal for a $17 vehicle registration fee. If the Council adopts the 2020 budget with the fee in place, the annual cost of vehicle registration will rise to $153. In the Mayor’s budget message she says: “I would prefer to pursue alternatives other than a vehicle registration fee, but it is the only option to achieve a modern transit infrastructure which supports our growing economy and decreases inequity in our community. Nevertheless, even with this new fee, the cost of operating a vehicle in Madison will remain among the lowest in the Midwest”.

This will be in open session right before they get to closed session. And then come back for the budget discussions.

This is the item:

THE ORDINANCE

“12.177 MOTOR VEHICLE REGISTRATION FEE.

(1) In this section, the following definition applies:

(a) “Motor Vehicle” has the meaning provided by Wis. Stat. § 341.35(1), except that it does not include those vehicles exempt from a municipal registration fee under Wis. Stat. § 341.35(2).

(2) Pursuant to the authority granted the City by Wis. Stat. § 341.35(1), all motor vehicles registered in Wisconsin which are customarily kept in the City of Madison are subject to an annual City of Madison Motor Vehicle Registration Fee of $40.

(3) This fee shall be collected by the Wisconsin Department of Transportation and distributed to the City as provided for by Wis. Stat. § 341.35 and Wis. Admin. Code ch. Trans 126.

(4) The motor vehicle registration fee revenue received from the Wisconsin Department of Transportation may only be used for transportation related purposes.”

2. This ordinance shall be effective on March 1, 2020.

THE FISCAL NOTE

This ordinance authorizes a local vehicle registration fee as allowed under state law. A $40 fee is anticipated to raise $7.9 million annually based on estimates of eligible vehicles registered in the city. Proceeds from a local vehicle registration fee must be used for transportation purposes. Use of the revenues from a local vehicle registration fee requires appropriation by the Common Council through a resolution (i.e., the budget) and is included as a revenue source for Metro Transit in the 2020 executive operating budget. The state vehicle registration fee is $85 annually. Dane County has a local vehicle registration fee of $28. The County fee applies to all eligible vehicles in the county, including eligible vehicles in the City of Madison. A $40 fee levied by the City of Madison would result in a total vehicle registration fee in the City of $153.

DRAFTER’S ANALYSIS

DRAFTER’S ANALYSIS: Wis. Stat. § 341.45 authorizes municipalities (and counties) to establish a local motor vehicle registration fee. These fees are collected by the Wisconsin Department of Transportation (WisDOT) at the time of vehicle registration or renewal, and are remitted to the municipality within thirty days after the end of the month in which the fee is collected. WisDOT retains an administrative fee (currently $0.17/registration). The revenues from these fees may only be used for transportation related purposes. This ordinance shall be effective on March 1, 2020. In order to be effective on this date, this ordinance must be adopted no later than the Council’s November 19, 2019 meeting.

This ordinance shall be effective March 1, 2020.

MEMO

TO: Common Council

FROM: Doran Viste, Assistant City Attorney

DATE: October 3, 2019

RE: Fact Sheet Regarding the Municipal Motor Vehicle Registration Fee (Legistar File #57669)

Wis. Stat. Sec. 341.35 authorizes municipalities (and counties) to establish a local motor vehicle registration fee (aka, a “wheel tax”). Municipal motor vehicle registration fees are collected by the Wisconsin Department of Transportation (WisDOT) at the time of vehicle registration or renewal, and are remitted to the municipality within thirty days after the end of the month in which the fee is collected. WisDOT retains an administrative fee (currently $0.17/registration). The revenues from these fees may only be used for transportation related purposes. Under State law and administrative code (Wis. Admin Code Ch Trans 126), the fee goes into effect no sooner than 90 days after adoption of the ordinance establishing the fee and notice to the State.

A proposal is currently pending (Legistar File #57669) that would create a City of Madison Motor Vehicle Registration Fee of $40 as of March 1, 2020. Under the statutory notice requirements, the City would need to provide proper notice to the State of the ordinance’s enactment no later November 29, 2019 to have the fee go into effect on March 1, 2020. If this ordinance is not adopted by the Council’s November 19, 2019 meeting, the City will be unable to meet this requirement to implement the fee on March 1, 2020 and the effective date would need to be amended. Conversely, if this ordinance is adopted at the Council’s October 15, 2019 meeting, and the ordinance is amended, the ordinance could be effective on February 1, 2020.

The following are some basic questions about the fee to assist the Council and the public’s understanding of the proposal.

1. How will the municipal vehicle registration fee be collected and distributed to the municipality?

WisDOT collects the municipal vehicle registration fee at the time a vehicle is first registered and at each subsequent registration renewal. WisDOT sends vehicle registration renewal notices at least 30 days before their plates expire. The renewal notice will show the total fee including any municipal vehicle registration fee. WisDOT sends the municipal vehicle registration fee payments collected to the municipality no later than 3 days after the end of the month in which they are collected.

2. What are the administrative costs associated with a municipal vehicle registration fee?

WisDOT collects the municipal vehicle registration fee for the municipality and currently charges an administrative fee of 17 cents per vehicle application. WisDOT sends the remaining amount to the municipality.

3. For what purposes can the municipal vehicle registration fee be used?

All revenues from the municipal vehicle registration fee must be used for transportation related purposes only. The revenues cannot be used to fund other programs. However, these revenues can be used to replace general fund revenues that would otherwise be used to fund transportation related programs, freeing up such unrestricted funds for other purposes.

4. What vehicles are subject to a municipal vehicle registration fee?

An automobile or a motor truck registered under 8,000 lbs. gross weight and customarily kept in the municipality or county that enacted the tax. This includes:

-

- Automobiles, vans and Sport Utility Vehicles (SUVs) that qualify as a passenger vehicle.

- Motor trucks and dual-purpose motor homes (trucks that can be equipped with a slide-in camper unit) registered at a gross weight of 8,000 lbs. or less.

5. What vehicles are exempt from a municipal vehicle registration fee?

- Vehicles exempt from municipal vehicle registration fee are:

- Buses, motorcycles, mopeds, motor homes, low-speed vehicles and trailers.

- Trucks registered at more than 8,000 pounds or registered as Farm or Dual Purpose Farm.

- Vehicles registered as Antique, Collector, Driver education, Historic military vehicle, Hobbyist, Human service vehicle, Low-speed vehicle, Medal of honor, Municipal, State-owned, Special X and one vehicle with Ex-prisoner of war registration issued to any qualified individual.

- Any vehicle with registration issued by a Wisconsin Indian tribe or band.

- Vehicles displaying Dealer, Distributor, Finance company or Manufacturer plates.

6. What determines whether a vehicle is customarily kept in a municipality or county?

This information is included on the vehicle title and registration. Applications for original vehicle title and registration request the county and city, village or township where a vehicle is “customarily kept.” Registration renewal notices also contain information on where a vehicle is customarily kept (see example below). Individuals may correct this information with WisDOT.

In the absence of an indicated municipality or county of domicile, the owner or lessee’s post office address may be used to determine municipality or county of domicile. This can result in incorrect vehicle location information for registrants who receive their mail from a neighboring community if they do not specify the correct location on their vehicle registration application. Beginning in October 2017, WisDOT uses a geographic information system (GIS) to determine vehicle location based on the street address when the location is not provided by the registrant.

WisDOT also implemented an online application that allows individuals (not businesses) to view and correct the location for their vehicles. See Vehicle kept in information for more information.

According to Wis. Stats. § 341.60, any person who gives a false address or location where a vehicle is customarily kept in an application for registration may be fined not more than $200 or imprisoned not more than 6 months or both.

7. If a county has a municipal vehicle registration fee in effect, can a municipality within that county also enact a municipal vehicle registration fee ordinance?

Yes. Section 341.35(6m) of the Wisconsin Statutes states that “If a municipality and the county in which the municipality is located enact ordinances under this section, a motor vehicle customarily kept in the municipality shall be subject to a municipal registration fee and a county registration fee.” Thus, both the municipality and county would collect a municipal vehicle registration fee simultaneously for vehicles subject to the fee in the municipality, if each chose to enact an ordinance.

Dane County has a municipal vehicle registration fee of $28. City of Madison residents whose vehicles are registered in Wisconsin and customarily kept in the City of Madison will pay both the County’s fee of $28 and the City’s fee of $40 for a total of $68. The combined fee will appear on renewal notices—not the individual fee of the County and the City.

For the calendar year 2018, 191,040 vehicles were eligible for the municipal vehicle registration fee in the City of Madison.

9. Does the City have the authority to waive the fee?

No. State law does not allow for exemptions or waivers to municipal vehicle registration fees, other than those stated above. Since the fee is subject to state law, the City does not have the authority to waive the fee. Hence, the City cannot waive the fee based on income or need.

10. What is the policy for refunds and proration?

A municipal vehicle registration fee is never prorated. The full fee is required whenever it is collected. Refunds for fees paid in error may be made directly to WisDOT.

AHEM, I HAVE A QUESTION OR TWO OR THREE OR FOUR

- Would the city be allowed to have a grant program for people are homeless, receiving Food Stamps or otherwise qualify for low income programs?

- What is the RESJI analysis on this?

- Where is the list of what this wheel tax will pay for?

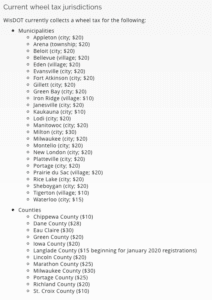

- Why $40 – the highest in the state? This is from the DOT website

I have supported the wheel tax for a long time. However, I also support a grant program for the lowest income people so its not so regressive. Also, I support more public comment and input opportunities.