Something for everyone on here. I’ll do a quick recap of the issues so you can see how much is going on at the city . . . with not many paying attention. Sadly, when you look at where our money is going, and the time, effort and energy of the staff, elected officials and others – its to accommodate developers. Not so much on equity and poverty. Here’s a snap shot of why, and why the budget is so important to changing our ways.

I only picked out some of the issues, there are more if you want to see them, just click on the agenda below.

4:30 PM BOARD OF ESTIMATES ROOM 260 MMB

– #1 and 3 – UW students and Hospitals and UW Employee unlimited ride pass programs.

My question here, and I may show up and ask it if I have time/can get out of work and downtown by 4:30, is why do the UW students and employees and UW Hospital workers get to pay $1.15 per ride, when homeless people can’t get that same deal. In October we did a survey of Homeless Services providers through the Homeless Services Consortium listserve and 69% of the respondents said transportation was a major issue for their clients. The only thing to rank higher was, of course, affordable housing, with 79% of the respondents saying that was one of the biggest issues.

That $80,000 in “transit for jobs” that the city gives to Porchlight every year in their annual budgets could be 69,565 rides instead of 32,000 if they were charged the same price. The “transit for jobs” bus tickets are given to homeless people mostly in the form of 2 ride bus passes and people are expected to be looking for jobs or housing, or anything closely related to that. If we had a similar program for homeless persons, when they could pay 55% of the cost for a ride, like students and commuters, THAT would be equity.

To look at it another way, if that $80,000 could be spent on low-income monthly bus passes ($27.50 instead of $55) for homeless persons, then it could buy 242 monthly bus passes, each month for people experiencing homelessness. There are solutions out there! And they don’t HAVE TO cost more money, we can just use our money more wisely.

I’m not saying Porchlight shouldn’t get the money, I’m saying the city should let them get more for their money! Like others have been doing for years.

Non-profit, affordable housing and homelessness

– #7 – Community Development Division Funding Process for the 2016 Budget

The city is re-organizing how they fund non-profits. What exactly that means, I’m unclear. We do know it means that city community services funding agencies don’t have apply for funding this year, as they are scheduled, unless your agency works with seniors or crisis (domestic abuse, rape, etc.) The rest of the agencies funded by community services just have to express intent to continue in their current contracts and update some data. There are “new” priorities that seem to expand, not get more specific about, who can apply for funding. I thought the intent of paying FCI was to hone in on our priorities, but everything AND the kitchen sink seem to be included at this point. I don’t see much of any change at all except that you only have to write grants every 3 years instead of 2? And I don’t know how anything changes on the CDBG side of things. Nothing to be alarmed about here, for those paying attention it might mean MORE funding opportunities, not less. The only thing I would say is that we appear to have wasted money on FCI and didn’t make anything any clearer on our priorities.

– #8 – Planning grant for City 10 year plan to end homelessness

I had no clue this was being proposed. I like the vendor who has been working with us on other issues. I would have loved for the Homeless Services Consortium to have discussed this at some point. I’m not sure we are hiring them to do the right thing to get to a good 10 year plan to end homelessness. I feel like we should be working on Zero 2016 coordination and goals and towards moving to a Housing First “in reality” plan. We say the words, we aren’t doing much to move to Housing First. I’m sure this process will allow for us to get to those issues, but if we are “planning” and that is what we got the money for, I’d much prefer we plan for “Housing First” as a reality. Of course, if this was never brought up, then there was no opportunity to express these ideas. And now “it’s too late”. Grrrr . . . .

At the last council meeting, Terrence Wall mentioned that his units were affordable, that none of them are over 80% AMI, which is the WHEDA standard for these types of projects. Of course, he was building high end housing for Epic employees or those who have 2 jobs. That was his testimony. To translate, here are the numbers he was talking about.

The median income for Dane County is $82,600

80$ AMI (broken down by family size and what they could afford if paying 30% of their income towards rent)

1 person – 46,100 ($1152.50 per month)

2 people – 52,650 ($1316.25 per month)

3 people – 59,250 ($1481.25 per month)

4 people – 65,800 ($1645 per month)

5 people – 71,100 ($1777.50 per month)

6 people – 76,350 ($1908.75 per month)

7 people – 81,600 ($2040 per month)

8 people – 86,900 ($2172.5 per month)

That is Terrance Wall affordable housing. That is WHEDA affordable housing. That is the “Low Income Housing Tax Credit” definition of housing. I hope we are asking for more than that! The RFP isn’t attached,so I don’t know what they are approving. I’m assuming they are asking for greater levels of affordability. But I don’t know how low. For reference, here are some other levels.

60% AMI (which is usually the definition the city uses for renters, 80% often used for homeowners)

1 person – $34,740 ($868.50 per month)

2 people – $39,660 ($991.50 per month)

3 people – $44,640 ($1,116.00 per month)

4 people – $49,560 ($1,239.00 per month)

5 people – $53,580 ($1,339.50 per month)

6 people – $57,540 ($1,438.50 per month)

7 people – $61,500 ($1,537.50 per month)

8 people – $65,460 ($1,636.50 per month)

Which is why we need to be talking about 50% AMI or 30% AMI levels. Which I HOPE the rfp does, but again, we don’t know.

50% AMI

1 person – 28,950 ($723.75 per month)

2 people – 33,050 ($826.25 per month)

3 people – 37,200 ($930 per month)

4 people – 41,300 ($1032.50 per month)

5 people – 44,650 ($1116.25 per month)

6 people – 47,950 ($1198.75 per month)

7 people – 51,250 ($1281.25 per month)

8 people – 54,550 ($1363.75 per month)

30% AMI

1 person – 17,400 ($435 per month)

2 people – 19,850 ($496.25 per month)

3 people – 22,350 ($558.75 per month)

4 people – 24,800 ($620 per month)

5 people – 28,410 ($710.25 per month)

6 people – 32,570 ($814.25 per month)

7 people – 36,730 ($918.25 per month)

8 people – 40,890 ($1022.25 per month)

Of course, if you’re on W-2 you only get $673 and can only afford $201.9 so these programs don’t really work even at 30% AMI. Individuals on SSI get $816.78 and can afford $245. A couple would make $1,232.05 and could afford $369.62.

Geez, I don’t know where to begin on this one. Here’s the brief bullet points.

– Hiring more officers means more arrests. With the disparity rates, that means more arrests of black people. Not helping.

– Diverting youth from the criminal justice system is a laudable goal, however, if you are arresting them first, and then they are diverted, you’re doing nothing to address the disparity in the arrest rate. We need strategies to address the arrest rate in the first place – why are black people arrested at such a high rate, are there policing policies and practices that lead to this result. I believe so, lets address those.

– While Use of Force needs to be addressed, hiring someone to tell us they did nothing wrong in the use of force will do nothing for the community and it will not increase trust. Currently the issue is, the police have to be willing to change the use of force policy, not keep it the way it is and justify it. Until the police are willing to modify that standard, hiring a new person to justify use of force is NOT something I want in this community.

– “these positions will be part of a Department-wide procedural justice initiative to build relationships with residents (including youth), to foster mutual trust and positive and productive police interactions, resolve conflicts to reduce violence, and to explain the criminal justice system” sounds nice, means nothing to me unless there are more specifics.

– This is going to cost us $580,000 – the grant will pay for 48% of the salary and fringe benefit costs of 4 entry-level police officers for 3 years for a total of $500,000. Meanwhile, we as a city will spend $58,000 already this year for uniforms, equipment and supplies, not currently in the budget. Eventually, we will be spending the full amount for these officers, which will be over $300,000 a year the way it looks.

– #19 – Report of Chief of Police: Year End 2014 & 1st Quarter 2015 Police Overtime

Hmmmm, nearly same amount in overtime during the first quarter of 2014 as in 2015? No additional overtime due to the Tony Robinson killing or resulting protests? Seriously?

TIF policy and TIF (related) Deals for developers

– #23 – Creating Section 4.29 of the Madison General Ordinances to require Proprietary Interest Protection Agreements in loan agreements.

This requires that projects that get TIF agree that when it comes to union issues, they have to enter into agreements that minimally state that:

1. Employee preference regarding whether to be represented by a labor organization for collective bargaining, and if so, by which labor organization, shall be determined based on signed authorization cards in a card check procedure conducted by a neutral third party in lieu of a formal election.

2. The employer and the labor organization shall at all times refrain from the use of intimidation, reprisal or threats of reprisal, or other conduct designed to intimidate or coerce employees to influence the decision by employees whether to join or be represented by any labor organization.

3. Signatory labor organizations shall forbear from taking economic action, such as striking or picketing, against the signatory employer at the worksite of an organizing drive covered by this section, so long as the employer complies with the terms of the agreement.

I’m sure developers don’t like this. I do.

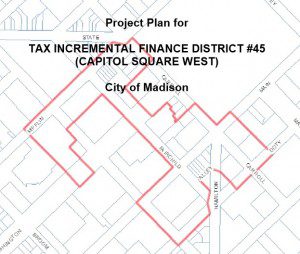

They’ve already approved loans in this district for the Anchor Bank project, and they will be approving the one below on W. Wash. Now here is the map and blight study of what the district will do and the project plan for the district. Too bad they didn’t do this the right way, but identifying areas of the city that could use TIF assistance, set a preliminary map and project goals, then identifying projects that might serve as a generator for a district, then letting developers know that this is where we want development. Instead, we let developers drive the bus, come up with projects and then we dance around trying to bend over backwards to meet their needs. We didn’t even know if the properties would pass the blight study before we were handing out money. But then again, everything is blighted. Even so, look at the germandering that had to happen to make this project happen.

It’s a developers world. What exactly in this project with help with diversity, equity or social justice? See anything? Anything at all? Looks like we have $3.4M in public works improvements (capitol square reconstruction – does it need it?), $25M for developer “loans”, $0 for affordable housing, $500,000 in staff costs. I don’t see jobs being created or affordable housing being developed, so what is the public getting out of this?

The city is making $460,350 on this sale of these rights, why not put this into the affordable housing fund, so there is some chance of getting something useful out of the TIF district? Why is the money being put in the General fund? One time money is great money to be spent on affordable housing. Since there is $0 in affordable housing in this district, this could make up for it.

$28,000 a year to start, the rent is 5% of the market value for the first 5 years, after 5 years it goes up based on the consumer price index. Where will that $28,000 go? If we are serious about equity, it should be dedicated to that. If TIF is to truly be just generating taxes for community services, then lets make it so. If it goes int he general fund, it will likely go towards the police department’s latest whim or shiny object.

Sigh. It’s only $2M, hardly worth looking into these days. Wish the council would call the developers bluff a little more often like they did with the Edgewater, since they needed $16M and then, viola!, when they didn’t get it, they still built the project.

Also, once again, they are approving the TIF without the Joint Board of Review approving the TID that the city is just approving earlier tonight. Looks like the new way of doing business . . . sigh. (Wait, isn’t that how I started this segment?)

Due to construction timing, the TIF Loan for this Project is anticipated to be disbursed to the Project in the first quarter of 2016, contingent upon Joint Review Board approval of the new TID that shall occur in 2015 but in advance of the TID #45 boundary and Project Plan being certified by the Wisconsin Department of Revenue (DOR). Such certification is anticipated on or about April 30, 2016.

In the event that the TID is not certified by the Wisconsin Department of Revenue, Developer shall be credited for the City portion of annual actual taxes levied on the Project to repay the $2,050,000 disbursed prior to DOR certification. The City portion of the average taxes over the first ten years is approximately $101,000 per year. Developer shall be obligated to repay all funds disbursed by the City as a conventional loan, amortized over ten years, together with the costs of issuance and interest on the unpaid principal balance at a rate equal to the rate of the City’s borrowing, plus one hundred basis points. Payments of principal and interest shall be made quarterly. In the event that the TID is not certified, this estimated credit and any Developer guaranty payments is sufficient to recover the $2,050,000 disbursed in advance of DOR certification within ten (10) years. Under this provision, all other provisions of the TIF Loan Agreement would apply. Developer would guaranty that annual property taxes levied against the project would equal or exceed a tax increment schedule provided in the TIF Loan Agreement.

Once the TID is certified by DOR, the TIF Loan is recovered through tax increments estimated at an average of approximately $261,000 per year. The full TIF Loan is anticipated to be recovered in eight (8) years.

How much have we already spent on this. Funny how we have half a million here and half a million there for some projects . . . and haggle over $10,000 on others. Admittedly, these are capital funds, but that definition is a bit weak. I also wonder, how much of this money will be wasted if the Judge Doyle Square project changes direction?

#33 – Authorizing a Request for Proposals (RFP) for a Topographic/Boundary Survey and Certified Survey Map for Blocks 88 and 105 required for the Judge Doyle Square Project and amending the 2015 Department of Planning & Community & Economic Development Capital Budget to fund both surveys. (This item is to be introduced directly at the BOE meeting of 6-8-15, for action at the 6-16 Common Council meeting.)

Deciding to demolish the loading doc. Apparently it will cost us $45,000 in architectural and engineering services before they even get to the work. Also, I guess this assumes we have already chosen a design?

#34 – Authorizing the termination of a lease between the City and the Madison Credit Union for space within the Madison Municipal Building located at 215 Martin Luther King, Jr. Boulevard. (This item is to be introduced directly at the BOE meeting of 6-8-15, for action at the 6-16-15 Common Council meeeting.)

Spending $3M so the Garver Property can be developed

#35 – SUBSTITUTE Amending the 2015 Adopted Capital Budget related to Acquisition of the Garver Replacement Property / LB Lands Purchase

This is buying 16.9 acres of land for $3,170,710. It is being paid for with 20% of the available parkland acquisition funds, half a million in stormwater funds, $22,410 from streets rights of way, and 13.74 acres will be for future development. This is all because of a deed restriction on the Garver Feed Mill propoerty that requires that land to be used for parks, this essentially replaces that property. The property we are purchasing is in the Town of Middleton. Not anywhere near the park land being lost. Years from know, when we are bemoaning the lack of parkland in our developed areas, I wonder how many with remember this deal?

Also, I can’t help asking. Which developer wants this land? The map attached doesn’t indicate which lands are “developable” that they would be selling.

Closed Session

#36 – Report from TIF staff on Exceptions to TIF Policy for the Union Corners Project

This is the topic, who knows what they will talk about

Exceptions to TIF Policy. The TIF Loan is contingent upon Common Council adoption of the following exceptions to TIF Loan Underwriting Policy that were stipulated in the Purchase and Sale Agreement executed on October 30, 2013:

Guaranty

a. Increment Guaranty—

The City hereby grants an exception to TIF Policy that “requires a personal guaranty of increment, sufficient to recover the debt service on City-financed TIF loans.”

Per the terms of the Purchase and Sale Agreement, a corporate guaranty of Gorman and Company, Inc. or its assigns was accepted in lieu of a personal guaranty.

b. Loan Agreement Guaranty—

The City hereby grants an exception to TIF Policy that “requires a personal guaranty to provide the highest level of security to the City, of the terms and conditions of the loan agreement. A corporate agreement may be acceptable if it provides the City with adequate security.”

Per the terms of the Purchase and Sale Agreement, a corporate guaranty of Gorman and Company, Inc. or its assigns was accepted in lieu of a personal guaranty.Equity Participation Payment

The Purchase and Sale Agreement, executed on October 30, 2013, granted an exception to the Equity Participation Payment, a requirement that Developer must pay a percentage of gross sales proceeds upon sale of a TIF-financed project to an unrelated third party. The Equity Participation policy was subsequently eliminated as part of the amended TIF Policy, adopted of a resolution by the Common Council on February 25, 2014. The City hereby recognizes that said exception to TIF Policy made in the Purchase and Sale Agreement is now authorized.

#37 – Report of the Garver Feed Mill Negotiation Status

No information available to comment on.

#38 – Report of the Judge Doyle Square Negotiating Committee

No information available to comment on.