This has the city’s updates on how COVID-19 will impact the city’s finances from nearly 2 weeks ago. It’s a old, but still good info. It is the latest briefing the council got.This time staff was not in the Municipal Building, the Mayor and staff appeared from their homes.

You can follow along here:

GETTING STARTED

The first 5.5 minutes was

- roll call (everyone present)

- instructions on how to do a virtual meeting

- muting and unmuting

- objections to unanimous votes

- raising your hand

- losing connections

- how to give public testimony

- encouraging to watch the livestream or on TV instead of zoom for better quality

- disclosures and recusals

- consent agenda (There are only 6 items)

- Items 4 & 5 were already requested to be excluded

- Alder Mike Verveer has a question of staff on item #2

- Alder Keith Furman confirms the staff presentation (item #6) is excluded

Items passed in the consent agenda were

- A Resolution to authorize the noncompetitive purchase of goods from Ford Meter Box Company, Inc. / Core & Main Inc. as a sole source provider of water meter lab testing equipment for the Madison Water Utility.

-

Authorizing an allocation of up to $300,000 in Federal Community Development Block Grant Program funds to acquire and rehabilitate a site for childcare services by the Dane County Parent Council, Inc.

Approving $900,000 in Federal HOME funds to provide additional support for the City’s Deferred Payment Loan (DPL) homeowner rehab program and the “Home Buy the American Dream” (HBAD) down payment assistance program.

Verveer asks about the memo and why there is an increase in interest in these funds from borrowers, specifically the “varying factors” for the increased popularity.

Community Development Division staff member Linette Rhodes says that in 2018 they increased the amount available for both loan programs. The Rehab program went up from $15,000 per unit to the $25,000 per unit. People could do a broader amount of work on their houses. They also started agressively marketing the program (local newspapers, program materials translated, using the NRTs and staff to promote programs.)

Verveer says it is a good problem to have, except for the reduced support from the state. He asks if they will continue to have less funding from the state for the American Dream program.

(Linette) Rhodes says when they had excess funds a couple years ago, when they applied off peak of the application process, they said that the City of Madison and Dane County were the most proactive municipality to use the funds. So if we have other municipalities that are not using the HCRI funds, I think the state will continue to support our increased ask.

Alder Barbara Harrington-McKinney asks about marketing the program through NRTs, what would that look like.

(Linette) Rhodes says that with the NRTs, when looking at connecting with banks, especially with the downpayment assistance program, the funding is that someone has to qualify for a first mortgage. As an example the Balsam-Russet NRT has made relationships with Old National Bank in that area working with the mortgage loan officer to start doing homebuyer education classes through the neighborhood center. They did a test run with neighborhood center staff so they would know how the class would be run so they could ask questions. They are trying to build relationships, not just so residents understand that the programs are available, we need to get the lenders comfortable using the programs and being able to explain the programs to people when they walk in to the bank. And we need to get the customers comfortable with banking in general. They are not just creating a brochure, but relationships in the community.

Harrington-McKinney says that she understands the informing the lending institution, but when you are sitting in the NRTs how are you informing the people around the table who are connecting with individuals who might qualify, what is that educational piece so we are understanding and sharing it as well. In the NRTs there are a lot of people around the table, how is that information being shared.

Rhodes says that they try to make sure our staff are knowledgeable, but she here’s her saying we should be working with Tariq to make it a point so that for every NRT there is an agenda item once a year where we are reminding city staff about these programs. We can do that.

Harrington-McKinney says, yes, and then sharing it out, its not just the NRTs and our staff, there are like 20 people around the table and having that information to refer them back to the staff is very important, she would like to see that expanded.

They record a unanimous vote in favor.

Rebecca Kemble asks how they came up with the numbers $50,000 and $250,000 for operating and capital and if they had something specific in mind when they came up with those numbers.

Dave Schmidicke, the finance director offers to answer the question. He says on the $50,000 is a level of transfer that allows them to move pretty quickly to respond to issues within agency budgets or between agency budgets. The threshold for budget transfers is established each year in the budget resolution. The $5,000 number was last changes in 1988, it’s over 30 years old. In normal times we can work through those issues and put budget amendments in front of the council, but in these times they felt $50,000 in the operating budget reflected a number within service contracts and supplies, that would allow them to move quickly but not a number that was overly large. On the capital side, the average size of the capital projects is about $750,000. They are often large movements that have to occur between projects or within projects and they felt that number was sized to reflect how those budgets change over time, or what we might have to react to, between specific project or between multiple projects. He suggests Laura (Larsen) should jump in if she has additional comments.

Mayor Satya Rhodes-Conway says her answer is that it is recommended by staff, she didn’t pick the numbers, they did and she didn’t have anything particular in mind.

Kemble asks if any transfers have taken place.

No.

Any proposals for any transfers come through the EOC or come to anyone’s attention, anything in the works?

Larsen says there was one request from Economic Development Division who is looking at trying to find ways to get dollars out to local small businesses, they are looking at how to use KIVA funding and funding in the cooperative development funding within the capital budget. Staff have been looking at how to utilize food funding that lives in different appropriations right now.

Kemble asks if that would require a transfer from other departments?

Larsen says in both cases those would require council authorized approvals in terms of the categories where appropriations would be moving across.

Kemble says under this item, they would not need council approval.

Larsen says those are just the items people have brought forth, she hasn’t seen the dollar amounts to know whether or not this particular item would be impacted by this resolution being adopted.

Kemble asks why its a blanket authority to the end of the year, instead of bringing individual items to finance and council as they come up, if there has been nothing in the last two weeks. Why are we not just doing it the normal way? Why do we need this?

Schmiedicke says he felt they are going to be in this situation through the year and have to respond to conditions they perhaps can’t even imagine right now and the budget resolution is approved by the council every year, so this can only be in place through the end of the year and when the council adopts the budget for 2021 that again would have whatever you decide as the council through that resolution would put those budget threshold amounts back in place.

Larsen says that because they are so early in the fiscal year, departments have been able to deal with unforeseen expenses without hitting their budget stops because they have a full year of appropriation, so as the response continues through the fiscal year we are going to be faced with more and more situations where people hit against their budget stop that they won’t have a solution to, they would just have less flexibility in terms of trying to deal with major unforeseen things as they move through the fiscal year.

Kemble says she is still trying to understand why we couldn’t take these unforeseen things up as they come along, and work them through the regular process, by introduction and referral to finance and back to council or by taking them up under suspension of the rules at council?

Schmidicke says . . . stutters a bit . . . say she described steps in the process that take time and you can certainly decide to do that, we put this forward as a tool given the unique and unprecedented situation we are facing right now and as Laura said, as we move through the year our flexibility diminishes as we spend more of the authorized appropriations and that may force them to move even faster to try to address specific costs that might come up, contracts we have to enter into rapidly and have dollars available to pay for them. That was the thinking in putting the proposal forward, and its for the mayor and council to decide how to proceed on that, that was their thinking in putting those dollar amounts forward in those amounts and given the $5,000 level is relatively small in the size of the budget that we are now dealing with compared to 30 years ago. And added to that is the unprecedented nature of this current situation we are in.

Kemble says there is nothing in this resolution that talks about reporting any of these transfers to council and under our regular budget resolution with the current limits, those aren’t reported, but did you contemplate reporting these things out or not? She doesn’t see anything like that in the resolution.

Schmidicke says they did not include a reporting mechanism, that is something you can consider and we can do that. All that information is readily available and they can make it available to you if that is the approach you would like to take.

Alder Harrington-McKinney says her questions were answered and hers were about fluidity during teh COVID-19, but the other piece is Laura said something about the budget stops, would you say more about that? In terms of fluidity and being able to respond, what is the regular process if this went through the regular process, what are we looking at, one month? 30 days?

Larsen says under the resolution the council adopts, staff are able to approve amendments to the budget under $5,000. So if someone is moving funding in the budget across a major category in an increment less than $5,000 that is handled and approved administratively. If they are asking to move funding across major categories of spending in excess of $5,000 that requires a council amendment and must be adopted with a 15 vote majority. Typically they are introduced to the council, referred to finance and back to the common council for approval. If we were in a time of year when council meetings are happening every other week, that approval process would be three weeks. But if we are going into a period like the month of April where there is a gap the turn around time could be 4-5 weeks.

Alder Donna Moreland asks the process to ask for reporting.

Mayor says you would need to amend the resolution.

Moreland asks how specific that would need to be?

Mayor says it would be up to you, but it could be as general as and reports will be made to the finance committees or it could be as specific as how often you want the reports to come to this body or a different one.

Moreland asks if this is an appropriate time to make the amendment?

Mayor says once they get through questions.

Verveer asks the Mayor if she would be supportive of an amendment that would limit this authority for the next several months, consistent with the action at the last council meeting relating to the emergency authority that this budget authority only be available through June 2nd and amended further if they need to.

Mayor says she would be amenable to that and a reporting requirement, but she would caution that the economic impacts of this are going to be felt more in the later months of the year, than now. And so the need for this will grow as staff mentioned. And that depending upon which model you believe, our peak here may be reached this month, but it may not come until June. So if we are peaking in June, we’re still going to be very much in the thick of it. She doesn’t object and certainly we can revisit the question if we need to.

Alder Marsha Rummel asks about the “nimbleness”, Schmidicke said that the further we go into the year, the more we have spent the budget and there is less unencumbered funds available, how do we see the role of the contingent reserve fund play into all these decisions of what may be the end of the year when we have spent some money on things we would have had go to that? Have you discussed that possibility.

Schmidicke says that the contingent reserve as well as the general fund reserve are both probably going to have to be tapped during this year, we don’t know the extent of that or where exactly it is going to have to be done. They are beginning to make projections based on 1st quarter and will monitor through 2nd and 3rd quarters. The economic impacts are only just starting to be felt. And how that plays out in terms of both costs in the city budget, but primarily on the revenue side of the city budget is where we’re going to have issues. The contingent reserve will likely have to be allocated to agency budgets, we are not sure where that will be, and there might also need to be appropriations from the general fund balance. He says what is before them does not allow appropriation from the general fund balance or the contingent reserve, it is just between agencies and within agency appropriations. Acitons related to the contingent reserve or general fund reserve will require council action including a 15 vote approval.

Amendment for reporting

Moreland makes a motion

Be it further resolved that staff will report on any actions taken under this authority at the next finance committee meeting.

Furman seconds.

Moreland says she would like to see reporting when actions are taken as a result of the resolution.

McKinney asks if that means that any action taken we would have to ask for it, or would it be on the agenda.

Mayor says that staff would build the report in to the agenda if there was anything to report.

They record unanimous consent in favor of the amendment.

Amendment to allow this through June 2, 2020 instead of “remainder of the calendar year”

Verveer moves, Harrington-McKinney seconds.

Verveer says this is consistent with the question he asked the mayor and he appreciates the mayor being supportive of the amendment. He says the date is consistent with the council action in terms of when the emergency authority would expire. This could be continued if necessary. He appreciates Kembles concerns and he hopes we can get back to more routine order of things later in the year.

Furman objects to a unanimous vote, they do a roll call vote.

Aye: Kemble, Harrington-McKinney, Verveer

No: Bidar, Furman, Moreland

Mayor declines to vote and it fails.

Discussion and Vote

McKinney says that the consistency of the action of the council was until June 2, we by no means think that this is going to peak by June 2, that is very clear, but does that give us the flexibility of moving the June 2 date forward.

Mayor starts to speak, McKinney says it is not before us, but the June 2 date is the date the council voted on.

Mayor says if she is asking about the underlying emergency proclamation, yes, the council can take additional action on that.

Kemble thanks her colleagues for the amendments and had Alder Verveers amendment passed she would have voted for this, but this item is something that, as Dave Schmiedicke mentioned, these typically not only require council approvals, but a super-majority of council, so there is a pretty high threshold for making decisions around the budget transfers for a reason and she’s concerned that . . . and even tho the reporting is there, thank you Alder Moreland, that the council is going to – hopefully we won’t lose track of what is going on in our budget because there will be reporting – but we are losing some of our decision making power over these very important items. CCEC will be meeting on Thursday to discuss how we as a body are going to collectively move forward in this crisis. How we as a body will be more nimble, can act more rapidly and we have in the past, especially finance committee, has has emergency meetings and can act quickly on items. And she thinks we can find a way to act quickly on intra-agency budget transfers that are essentially budget amendments and she wished that we would still be part of that decision making process and she knows we can find a way to do that. That is the reason for her no vote today.

Roll Call

Aye: Bidar, Furman, Harrington-McKinney, Moreland, Verveer

No: Kemble

Kemble asks staff to explain the underlying statutory limit to our authority under room taxes as compared to the statutory limit over our decision making power over property taxes. Why can we do this for the room tax when we can’t make similar adjustments for property tax payments.

Schmiedicke volunteers, he says the room tax is authorized under state law that local communities can implement a room tax and they implement it through ordinance, and it is in Madison General Ordinances that we have the interest and penalty requirements associated with late payment of room taxes. Room taxes are paid quarterly and they are collected on the gross receipts of those transient room operators that are in effect issues a permit by the city. The late payment, interest and penalties are established through city ordinance. The property tax installment process is established under state law. It authorizes taxing jurisdictions through ordinance to establish installment dates, but they have to be set no later than the August prior to the year the taxes are collected. The interest and penalties are established through state law, not local ordinance. Room tax we establish the penalties through ordinance, the interest and penalties on late property tax installment payments are established through state law.

Kemble asks if there are legislative efforts to amend property tax deadlines and fines.

City Attorney Michael May says that he knows a little bit about pending legislation, but not if the legislature will act on it. He says there is another difference. On property taxes state law says that if you are going to amend the time the tax payment is due, you have to have done it by August of the prior year. Unless that is changed we have no authority to change the date property taxes are due or the penalties or anything like that. The room tax has no such limitation, we set the dates, we can change the dates at any time.

Schmiedicke says on the legislative action front, the governor has included in his second package of changes in response to this public health emergency a waiver of interest and penalties on a number of payments including property taxes. The legislature is also working on an omnibus bill in response to the public health emergency, for a meeting to be scheduled (extraordinary session) that also includes some sort of waiver, interest and penalties. Whether or not it includes the authority to change installment dates is yet to be seen. There is a recognition by the governor and the legislature of this issue.

Moreland says this speaks to quarter one, what effect will this have on quarter 2 and beyond. She assumes the July date would have affected quarter 2, it would have been the due date for the quarter 2 payments.

Schmiedicke says that this would waive interest and penalties on late payment only until the due date of the second quarter payment. These room taxes have already been collected by the hoteliers on behalf of the city and are due to the city and we are effectively giving these entities a short term loan. We are giving that break for that first quarter with the expectation that they would begin to pay both the 1st and 2nd quarter by that due date of July 1st at which time the interest and penalties would again come into effect.

They record a unanimous vote in favor of the item.

COVID-19 Response – Fiscal and Legislative Update

Presentation by Schmiedicke. Screen sharing problems, public is out of luck. Alders have to look at what was sent to them. The mayor looks for it so she can share her screen.

This is updates to the economic impacts and some description of legislative action that have occurred over the last two weeks since the last update.

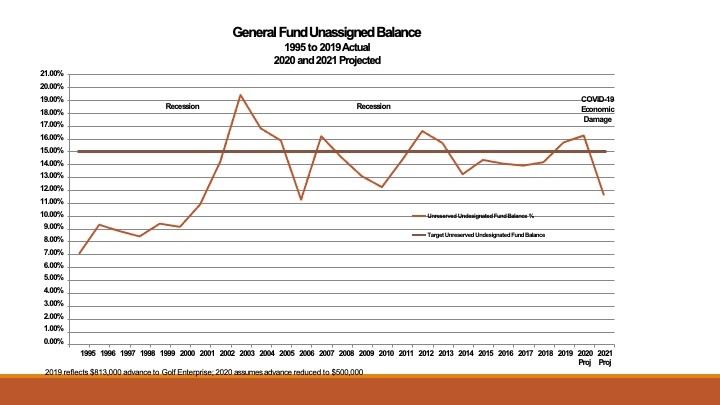

Mayor shares her screens and will move the slides for the finance director. This is a reminder that the city is well positioned. We are in good shape for the economic distress that is about to wash over us. We have relatively strong general fund reserves, he already talked about how they will have to use the contingent reserve. We’re in relatively good shape with debt and pension costs and we have strong infrastructure.

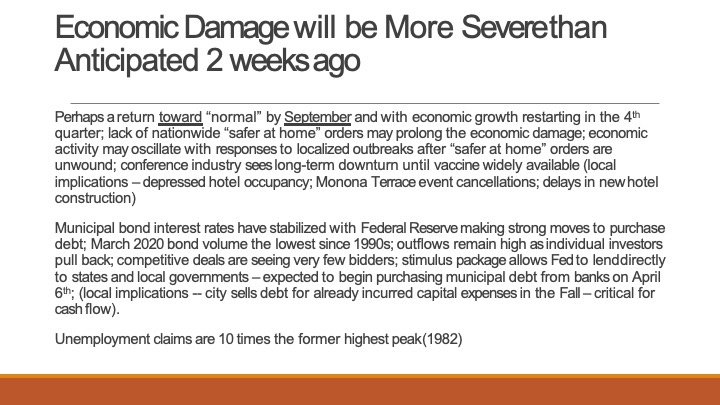

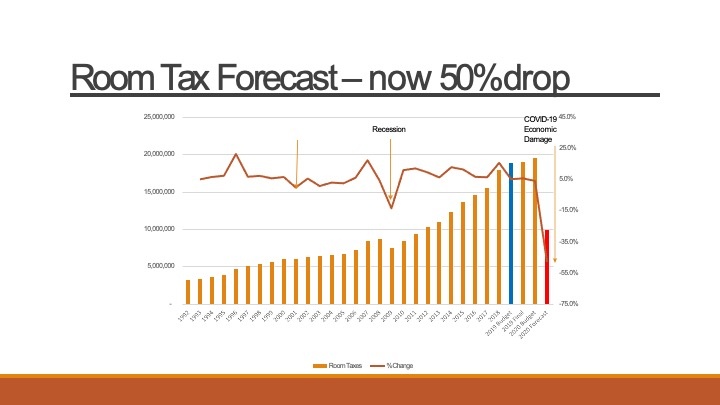

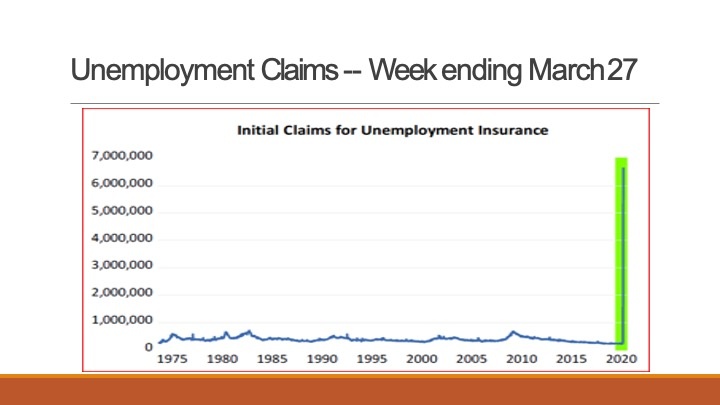

He says they may have already read this, the damage will be worse than they talked about 2 weeks ago, a return to normal by perhaps the end of the second quarter, maybe by the beginning of the 3rd quarter and with growth perhaps occurring in the 4th quarter of this year. A lot of that will be determined by how long the safer at home orders remain in place. The lack of a nationwide approach could further the economic damage, and we will probably see oscillations of economic activity as there may be localized outbreaks as the generalized orders in states are rolled back. Room Tax and Monona Terrace – until individuals are willing to travel and be in groups again, which may not be until a vaccine is available, there probably will not be large scale meetings, which means you will have depressed hotel occupancy and event cancellations and delays in new hotel construction. On the municipal debt side of the equation interest rates have stabilized. The fed has moved strongly into that market to stabilize interest rates. The bond volume was at its lowest level in 25 years. Individual investors who make up 70% of the municipal bond market are exiting that market rather dramatically, given what they see as risks to state and local government budgets. They are also seeing competitive deals having very few bidders, that may change when the fed moves (starting today – April 6th) with the authority in the CARES Act, they will probably begin purchasing municipal debt from banks. The implications for Madison are not immediate, we sell our debt in the fall, it is a critical cash flow sale for us, we are incurring capital expenses on projects and we carry those costs and then we gather the revenue to pay those costs with the sale of the debt which is roughly $100M. Hopefully markets will return to some level of normality by then. Unemployment claims have skyrocketed, they are 10 times the former highest peak, which occurred in 1982.

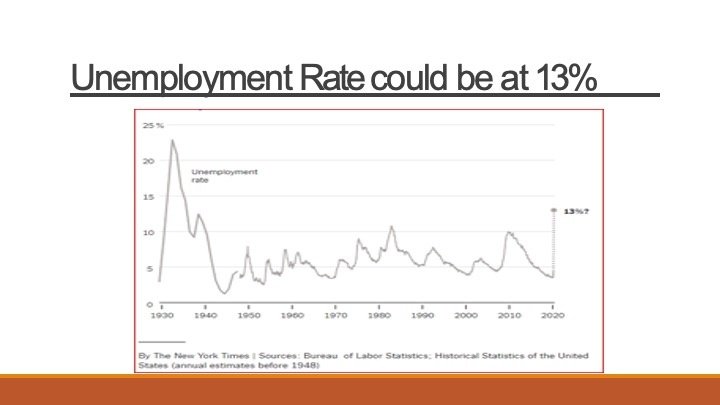

One of the things that has happened is the Congressional Budget Office came out with estimates last week where they predicted the gross domestic product would decline as much as 7% in this which is a 28% in gross domestic product, those are incredible numbers and those declines could actually be larger than that depending upon what happens. The unemployment rate is probably at 12-13% based on unemployment claims filed over the last couple of weeks which were unprecedented. The CBO expects that the unemployment rate will go to the 12% and will still be as high as 9% by the end of 2021. They expect unemployment to remain high through the next year and a half. They base that one social distancing continuing in its current state for the next three months and then later outbreaks of the virus, and social distancing will decline by only 75% by the end of 2020. There will still be significant social distancing requirements in place.

This shows the dramatic jump of unemployment claims for the week that just ended. Over 6 million in claims. Back to the mid 70s that number never broke above 1 million claims in one week. Even in the great recession of 2009, where you see a little blip, or the deep recessions of the early 1980s. This is unprecedented waters we are in.

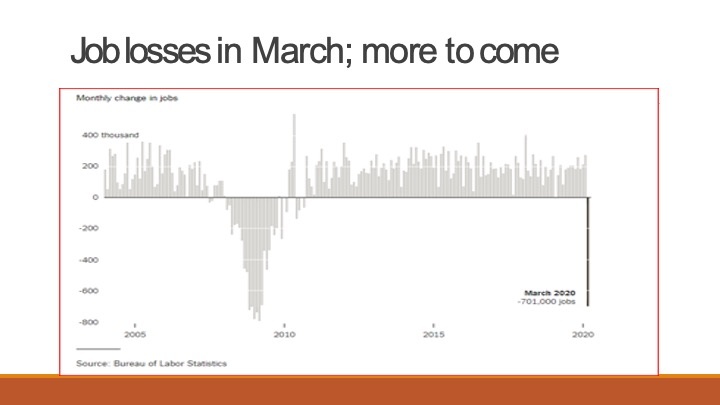

The job losses were dramatic in March. In contrast to the great recession of 2008/2009, and with most recessions we move in to it at some sort of pace, this pace is unprecented and the economic impact will be felt for quite some time.

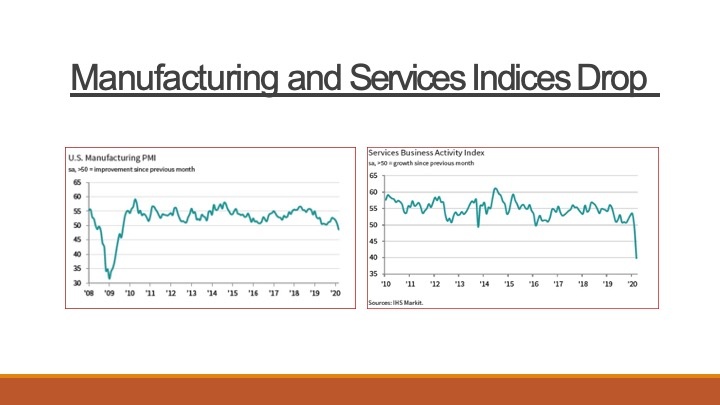

We’re starting to see the impacts in manufacturing and services. You’ll see that drop on the slide on the left is US manufacturing, that is the most rapid pace of drop since 2009. Future indices will probably show a drop. The services sector has dropped even faster, this index has only bee in place since 2009 and you can see we are at historic rates of fall off in services. Not surprising with most activity stopped through the safer at home orders in most of the country.

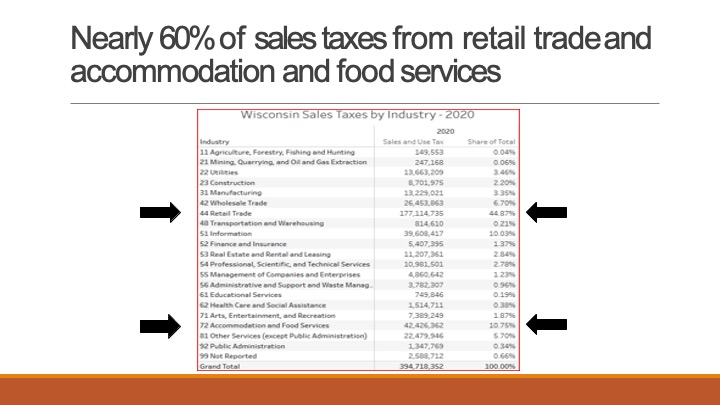

One of the major revenue streams for the state and county is sales taxes. 60% of the sales taxes are in these two areas of retail trade and accommodation and food services, that are heavily impacted by the changes in economic activity brought about by the public health emergency. This will impact the state budget dramatically and county budget will be affected as well.

2 weeks ago they predicted the room tax would drop 30%, now they are predicting 50%. More info may result in a greater drop. They will have to work through how to address that, the impact on programs and the general fund balance.

He reminds them where the general fund balance is at, and 2 weeks ago they predicted this level, but it could drop further depending upon the economic dislocation that we are seeing and how it plays out in trying to maintain programs that are funded from the room tax and other sources of revenues that are particularly sensitive to the changes in the economy.

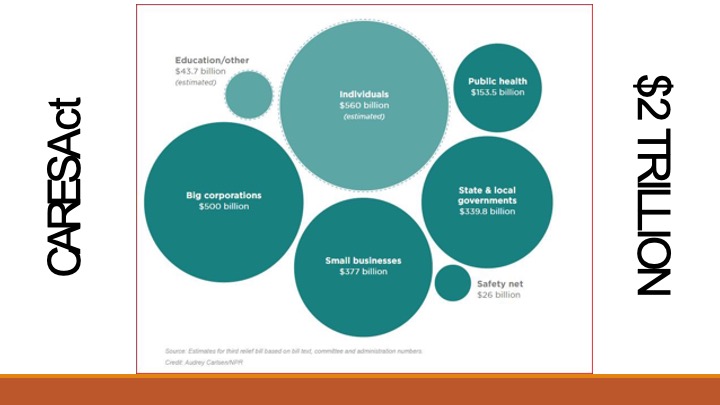

This graph gives a quick picture of the CARES Act, $2 trillion in economic support to maintain individual (half a trillion dollars), large corporations such as the air line industry (half a billion), small businesses through forgivable loans to maintain people on payroll so they can accesss benefits (a little under 400 billion) and state and local governments, some of it is medicaid support as well as support through specific programs, including a coronavirus relief fund ($150 billion) and about $30 billion for higher ed and K-12 districts. Public health costs and safety net support.

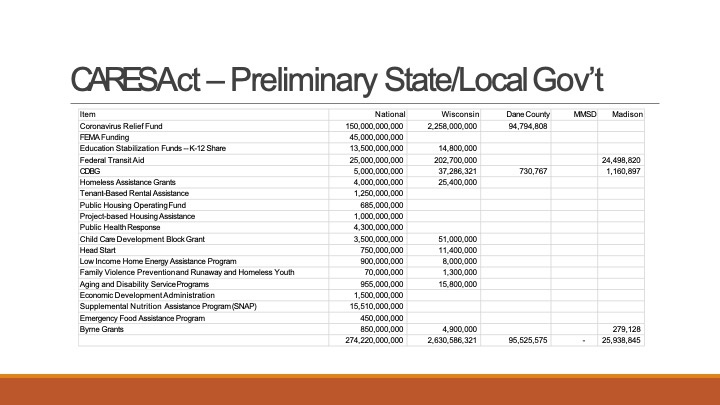

These are some of the specific programs in the CARES Act, these numbers are shown at the national level. The corona virus relief fund, FEMA money, education stabilization, federal transit aid and CDBG and so on. There are some estimates for how it might play out in Wisconsin. Dane County will get a share of the coronavirus relief fund, maybe upwards of as much as $95M that must be used on public health emergency response costs, it cannot be used to stabilize lost revenues, such as the sales taxes Dane County could lose as a result of this. That is a follow on issue that Congress will have to hopefully respond to. In terms of what we know will happen directly to Madison, the federal transit aid will be about $25M for Metro, it has to be spent on costs related to the public health emergency. Same with the CDBG funds and the Byrne grants at the bottom. They formed an internal staff team to look at these issues and propose citywide approaches on them. Kwasi from the Council Chief of Staff is a member of that group and will be talking through strategies on how to best coordinate these dollars.

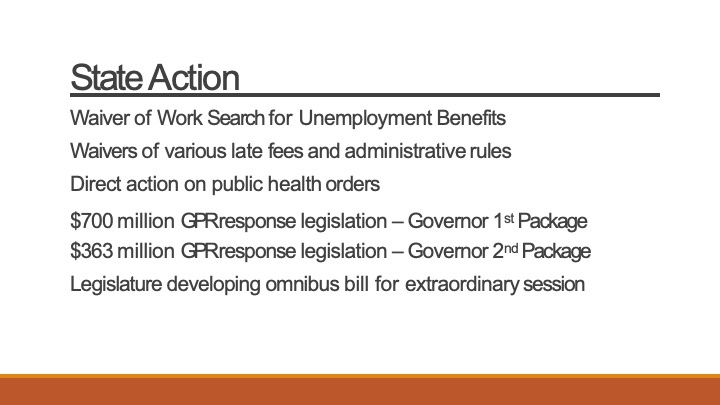

He covered the first 3 items 2 weeks ago. The governor has offered 2 packages totally over $1B in state funds for unemployment insurance, public health response, some support to local government, funding for state agency costs, for their response efforts and some of the changes around relief to individuals with waivers for late payments on property tax installments. The legislature is working on a omnibus bill that would touch on these specific issues.

Questions

Harrington-McKinney asks about the city being well positioned and then the rest of the slides show that the forecasting is continuous and the recovery from the crisis still is unknown. Say more about the city being well positioned.

Schmiedicke says we have relatively strong reserves and debt capacity to respond assuming markets are out there to sell our debt and we have a strong infrastructure. It’s not to say we’ll come through this unscathed, but we’re in a position, as opposed to many places around the country that may not have significant or sufficient reserves to offset the drop in revenues associated with this, we are not reliant on sales taxes. Our property taxes are relatively stable in an event like this. And we don’t have large scale pension costs that we have to fund, as many other state and local governments have to address. When you take those all together, we’re in a better position that many other government around the country to address what is going to be happening with our nation, state and local economy. That’s not to say we won’t have challenges, but those challenges are not as dramatic as they will be in some parts of the country. One example is the access to debt markets, that is not an issue until the fall, there are many school districts and local governments around the country that have to be able to borrow short term to pay their every day bills and they were having trouble doing that over the last couple weeks and the fed stepped in and allowed those markets to continue to function. We have sufficient cash balances to pay our bills and pay our staff. So we’re in a good position relative to other parts of the country because of those steps we’ve taken to make sure we have a strong financial foundations.

Mayor says there are cities around the country that are laying off or furloughing workers at this point in time, which I assume is because they are in a weaker financial position than we are.

Harrington-McKinney asks about the contingency reserve, but is sounds like we are not concerned right now?

Schmiedicke says that we have limits under the state’s expenditure restraint program, where if we spend more than those limits we lose $7M in state aid. Under the current emergency issues by the governor, we can spend dollars on this public health response and not violate that threshold. That is not an issue. He thinks we will have to spend the contingent reserve based on where we see cost trends in this years budget. We may have to tap into our general fund reserve overall, make appropriations from it, depending upon decisions made in response to things like that 50% reduction in room taxes, for example.

Verveer asks about money beyond the CARES Act apporpriation, what funds are available to us under the federal emergency declaration through FEMA. In the last report you said various city agencies have been tracking our expenses related to this crisis for several weeks. Can you remind us that there is available FEMA reimbursable public assistance outside of the CARES Act specifics.

Schmiedicke says that there was $45B in FEMA, we are tracking all of the costs associated with responding to the public health emergency and we will then submit reimbursement through the county and then the state to the federal government to FEMA to be reimbursed for those costs. The timing of that reimbursement is uncertain and the extent to which all of the costs are reimbursed is also uncertain, but we are making sure that we are keeping track of all those costs and doing everything we can to seek reimbursement for them.

Mayor says that today she talked to Senator Baldwin herself about that and is hoping for an expanded verison fo what eligible costs would be under that FEMA reimbursement.

Verveer asks if there is a concern that the current eligible expenses is somewhat restricted.

Mayor says in the past her understanding was that it was only overtime that was eligible, but we obviously have significant amounts of regular work time that are being devoted to the emergency.

Verveer asks for an update on the number, but when you last reported last month it was $125,000 excluding staff costs. Do you have an estimate for us this evening?

Schmidiecke says they have spent about $1.2M with about $700,000 related to personnel costs, most of it will be straight time, which is what the mayor just talked about. Some of it is overtime, but not a lot. The rest is supplies costs, PPE, some services contracts including facilities for first responders to convalesce.

Verveer asks if that includes the extraordinary costs to administer the election that is apparently back on for tomorrow.

Schmidicke says some of the election costs are in there, but probably none of them are.

Verveer says probably none of them are? So the work engineering and others have done creating those plexiglass barriers are not in the estimate yet.

Larsen says that those supply costs are being captured, the staff time spend on managing absentee ballots and working the polls tomorrow and all the staffing around the election are not.

Verveer asks if there are updates about administrative actions we are taking to deal with the financial impact of the crisis? Any update? New hiring and non-essential purchases being closely reviewed.

Schmiedicke says no updates. They will discuss options when they complete the first quarter projections. The end of this money they might begin to contemplate those.

Verveer asks about the quasi-hiring freeze, what impact will the administrative actions review has on reclasses of employees. He says that last year reclasses were strictly monitored and almost came to a halt. Is that the case now, we didn’t have any resolutions on our agenda today, but there were last meeting.

Mayor says that we have not seen very many, folks are working on other things. She says they will review carefully because in most cases there is a fiscal implication. In general they were looking at an equity analysis pre-virus, of the reclass process to improve the way they do this. Things had been moving slower than in previous years, at this point, they are still reviewing them with a fairly high level of scrutiny for that reason and for fiscal reasons.

Arvina Martin asks about disbursement of CARES funds issues because of the lame duck laws that were passed at the state level after the last election. If that causes a hold up in the disbursement of CARES funds will that impact us in any way.

Schmiedicke says its hard to say. Some of the dollars will flow directly to the city, so they won’t pass through the state at all or be subject to reporting requirements. Some will flow to the state and the city might be able to access or others within the city might be able to access and how that plays out in terms of timing is yet to be seen.

Moreland moves to adjourn.