City has only spent $125,000 on the crisis beyond staff time. “Normal” budget process being delayed, budget will be focused on cost-to-continue and Covid-19 responses.

HOW TO PARTICIPATE IN MEETING AT 4:30 TODAY

They will do a full presentation at the Finance Committee today at 4:30, here’s a preview in case you want to send emails to your alders to ask questions about the presentation. Or otherwise participate in the meeting. Here’s the details on how to participate, there are no call in options.

Members of the public may participate in person by attendance at the noticed location or by sending an email to members of the body at financecommittee@cityofmadison.com. Overflow rooms for the meeting are in Madison Municipal Building Room 202 and 206.

CURRENT AVAILABLE INFORMATION

Here’s the information and major take-aways.

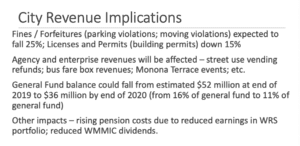

Revenue/Income

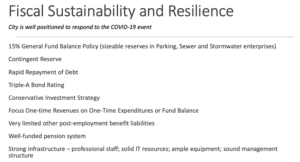

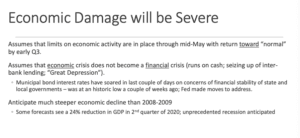

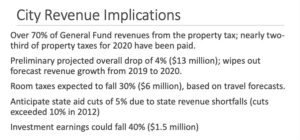

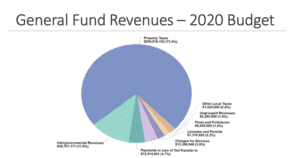

- The city is in a better position than the county and state because we rely on property taxes that have been paid, we don’t rely on income tax.

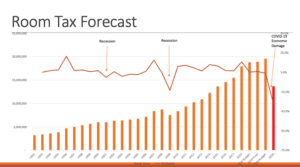

- Room taxes are expected to fall by $6M

- Expecting state aid cuts od 5% due to state revenue shortfalls

- Investment earings could fall by 1.5M

- Fines/forfeitures expected to be down 15%

- Street use vending, fare box and Monona Terrace income plus others will be down

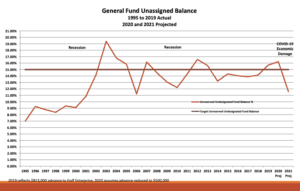

- We could go from $52M in our general fund to $36M by end of 2020.

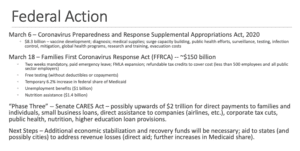

Federal Assistance

-

March 6 – Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020

$8.3 billion – vaccine development; diagnosis; medical supplies; surge capacity building, public health efforts, surveillance, testing, infection control, mitigation, global health programs, research and training, evacuation costs

- March 18 – Families First Coronavirus Response Act (FFRCA) — ~$150 billion

- Two weeks mandatory, paid emergency leave; FMLA expansion; refundable tax credits to cover cost (less than 500 employees and all public sector employers)

- Free testing (without deductibles or copayments)

- Temporary 6.2% increase in federal share of Medicaid

- Unemployment benefits ($1 billion)

- Nutrition assistance ($1.4 billion)

- “Phase Three” — Senate CARES Act – possibly upwards of $2 trillion for direct payments to families and individuals, small business loans, direct assistance to companies (airlines, etc.), corporate tax cuts, public health, nutrition, higher education loan provisions.

- Next Steps – Additional economic stabilization and recovery funds will be necessary; aid to states (and possibly cities) to address revenue losses (direct aid; further increases in Medicaid share).

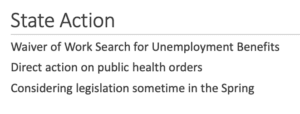

State Assistance

- Waiver of Work Search for Unemployment Benefits

- Direct action on public health orders

- Considering legislation sometime in the Spring

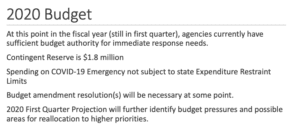

Status of 2020 Budget

- At this point in the fiscal year (still in first quarter), agencies currently have sufficient budget authority for immediate response needs.

- Contingent Reserve is $1.8 million

- Spending on COVID-19 Emergency not subject to state Expenditure Restraint Limits

- Budget amendment resolution(s) will be necessary at some point.

- 2020 First Quarter Projection will further identify budget pressures and possible areas for reallocation to higher priorities.

Administrative Actions

- Mayor anticipated provisions in federal Families First Coronavirus Response Act (FFRCA) by issuing guidance on emergency paid leave to address COVID-19 impacts. An Emergency APM is being drafted that will eventually be followed up with a resolution and ordinance.

- New hiring and non-essential purchases will be more closely reviewed (similar to August 2019 actions).

- Reviewing options for deferred payment of property tax installments and water bills (both require state action); also reviewing options for deferral of other fees and modifications of contracts to meet emergency needs.

City costs due to COVID-19

- Public Health began tracking costs in January; remaining agencies began March 10th

- City costs to date = $125,000 (excluding staff costs)

- Costs will increase with purchase of emergency supplies, IT equipment and subscriptions for remote work and meetings, and staff time.

- Expenses will be closely tracked for reporting purposes and potential federal reimbursement programs.

2021 Budget process delayed

COVID-19 response is an organization-wide effort; capacity is limited for a “normal” budget development process.

- Focus on “cost-to-continue” current services and COVID-19 recovery

- Defer capital budget kickoff to May; 2021 budget and CIP would only be adjusted for recovery efforts.