An overview, room tax commission and public testimony which is primarily about parking enforcement officers moving from police department to Parking Utility and praise for 3.25% wage increase for city workers to have equity with police and fire.

The first part of the meeting is blogged here, its the non-budget items.

PUBLIC COMMENT

Public testimony was taken prior to the Finance Committee going into closed session for an hour on Judge Doyle Square. There was a half hour of testimony that had the following speakers speaking on the following items.

- Hannah McKaren from Sun Prairie is against – a Dane County dispatcher, doesn’t support moving the parking department from the police department to the parking utility for efficiency and safety reasons. Capacity to tow vehicles will require MPD to respond, parking officers won’t be dispatched or have access to police records. They also won’t have radios and be able to call for assistance immediately or safety alert tones. The national crime info won’t be accessible and they won’t know if the vehicle is stolen or if the person inside is wanted and armed.

- Walt Jackson, AFSME Local 6000, neither supporting or opposing. Thanks the mayor for including the 3.25 pay increase and to ask for council support. This will help get to pay equity with fire and police. It will also help with the 300% increase for health insurance. He also thanks her for the commitment to pay equity for women and minorities and to not lose sight of that. He also notes concerns about relocating parking enforcement and forestry to other departments. He says that the meet and confer process was not a product of how the city works with Local 6000. He says the timing and news of this was not well received. This is not the city way. He says the parking enforcement officers needs to stay in police.

- Mike Thompson, Orchard Ridge Neighborhood Association, neither supporting or opposing. He has hand outs. He says that there are 420 souls in his neighborhood and they have been surveying the neighborhood to see what people are interested in through next-door, facebook, etc. 215 responses in the first one. Public safety was a major concern. The second survey was to find out why, people are concerned about walking after dark and they wanted to explore that further. They asked why, the top answer was – 35% were afraid of being assaulted or robbed, next was speeding vehicles. He says some solutions are adding more anti-gang and anti-drug officers. More neighborhood officers. More traffic cops. After schools programs was far down on the list in terms of effectiveness. The most important part of this is if people think we need more cops, how many more do we need. They gave the option of 0, 19 (the number of patrol officers) or 31. 76% favor 31 officers. 14% suggest hiring 19. 6% don’t want any more.

- Wendy Riechel of Tokay Blvd. neither supporting or against. She is there to ask for more police officers to be added to the budget. She schedules 1 or 2 police ride alongs every year so she can get a better understanding of what is going on in the city. Why are people calling the police and what kind of help do they need and how are the police handling those calls. She is concerned about changes, like when the officer points out they are the only squad car available in the district or several districts. Or when the dispatcher announces that they are going to priority only calls. The police are struggling to meet their mandatory minimum staffing results. Officers can’t get time off and have to stay late to cover the gaps which hurts morale and makes it hard to recruit and keep officers. Officers can’t ask for time off to take trainings outside the department. She wants the 12 officers pulled from neighborhoods and drug and gang units to not be on patrol. She says that a west-side officer tells her he works downtown overtime and he can often text or pull aside people he knows from the neighbored to stop them from doing something they may later regret. This cuts down on calls and helps avoid arrests. A man who was shot and killed a person confessed to a neighborhood officer that he had a relationship with and the plea deal avoided a jury trial that saved the taxpayers thousands of dollars. Patrol officers can’t spend that quality time in the neighborhood. This is preventing grass-roots crime prevention and community building going on in the neighborhoods, especially the most challenged ones. People call the police because they are in danger, or they feel threatened or afraid or in desperate circumstances. Please add patrol officers.

- Cynthia Roskowitz? or Roscovich? of Manley St in opposition and wishing to speak. Opposed to moving parking enforcement to parking utility. She is a voter, member of Madison Police Department family since 1998. She has on a MPPOA shirt she wears in support, she is on the equity team, pride team and vehicle operation review committee. She has been injured in the line of duty more than once in 21 years. If she didn’t have access to police back up her injuries would have been worse. She is permanently disabled due to those injuries

- Rebecca Munford, Littlemore Dr. in opposition wishing to speak. Parking enforcement officer for the police department since 2005. She is from rural Michigan where women needed to stay in their lane and LGBTQ people feared for their safety. She moved to Madison lesbian police officer, she was shocked. She became an alternate side parking enforcement job and she got back on her feet and could be 100% me. That was the first time MPD saved her life, in 2015, she got a full-time job with benefits and a good job. In 2018, she was diagnosed with stage 3 breast cancer, employees supported her through her survival. She applied to work at the Madison Police Department, not parking utility. The feedback she gets from Parking Utility workers is that “its a job and it pays the bills”, MPD has saved her more times than twice, its more than just a job that pays the bills for her. She thinks that is true for others. When she knows she is supported by MPD and the city, she gives that support back. Will this job remain whole under parking utility, she thinks “no”. She thinks there will be lay offs and jobs will be eliminated. If you move parking utility you will be tearing apart 31 jobs, lives and families.

- Michael Parker, in opposition, from Fort Atkinson. He’s a parking enforcement officer. He starts work at 2:30 at night and he needs the dispatch, the radio and the CAD. He says they respond to calls in “we’ll call them challenging neighborhoods” and its due to having the CAD and the radio that he feels safe doing so. He has personally received 53 stolen vehicles, even at $10,000 a piece that $530,000 that the city got back. This year they are up to 20 vehicles, that is what the CAD can trace. Losing the CAD and NCIC it will be detrimental to the city. He stays in the communities and knows the officers. He says he explains how they can get rid of the “not stopping, standing” parking signs. He applied to the MPD because he takes pride in his work and he doesn’t see that out of his future co-workers at the parking utility. He wants to stay with the police because of the CAD, the radio and NCIC.

- Joseph Keys, Regent St. neither supporting or opposing. Wants to add more police officers. He says that police have been reassigned to patrol and there is a need for proactive policing and crime prevention. Community officers prevent crime by creating trust with at-risk communities and identifying issues. Attorney General Josh Kaul talked about the need to prevent crime against senior citizens and that community police officers played an important role in that prevention. He talks about active shooter training he took and it was invaluable. He is also worried about traffic and aggressive driving. Since mid-July there have been 5 fatal traffic deaths, they need a traffic enforcement unit to stem the deaths. He says there are COPS grants, but the city has to support the cops in the future, the need for more police is not just a current concern, the city will have an additional 100,000 residents by 2050. Using the MPD shift relief factor fo 1.89 per 1,000 residents, Madison will need an additional 189 officers by 2050. That is 6.3 officers each year for 30 years.

- Dan Rolfs, Oakridge Ave, from MPSEA. He is representing the 450 employees in comp group 17, 18, 43 and 44. He explains the work all their members do. The mayor has a 3.25% increase that represents pay equity for their members. He is there to support that.

- Niel Rainford, AFSCME Local 6000 in support. He is one of the staff with AFSCME Local 6000 that represents the general municipal employees in all departments. He is there in support and to ask for council support, specifically for the increases for pay equity. They also appreciate the decision of the mayor for revenues to pay the city’s obligations especially in light of the scant option allowed by law. Even tho they have some concerns others have spoken to, he is looking forward to working through them.

People registered but not wishing to speak

- James Carne, from Watertown in opposition

- Greg Gotsien, from Ashland Dr. neither supporting or opposing

- Jordan Walburger, from Oconomowoc, in opposition

- Trevor Karl of Lake Pointe Dr. in opposition

- Lara Marinella, Madison City Attorney’s Association in support

- Linda Horvath, Oakridge Ave, supports 3.25% raise for all general city employees in the first pay period of 2020 to achieve wage equity with police and fire collegues

- Kathleen Fullin of Farley Ave, League of Women Voters in support of clerk’s budget

- Jamie Healy-Plotkin from Kendall Ave, Madison Public Library Board President in support of the teen librarian, Pinney staffing and the library budget.

Verveer asks Walt Jackson about the meet and confer process not being followed and mentioned Forestry being transferred to Streets Division, he asks if Local 6000 has concerns about the transfer of Forestry because he thought that wasn’t the case in previous conversations and in talking to management.

Walt says that there are some logistical concerns and questions. The table officers support the decision, both financially and organizationally, but they have concerns about how that is going to work, the tasks are compatible. He concern is about how this was communicated to labor.

Verveer asks if the forestry staff was informed in a fair manner. Jackson says yes, he heard that second handed. He says he found out about the parking officer issue at the press conference, that is a shock.

Verveer asks if local 236 has concerns about the transfer of forestry to streets. Jackson says he has not spoken to Michael O’Brien directly on that, but members have concerns about promotions or job opening. Local 6000 will still represent forestry even tho they will be in Streets which is unique. Will the staff be able to apply competitively with any 236 jobs that open. He says that can be worked out soon, unlike the parking officer issue with a huge cultural shift and safety and dispatch and how all that will work.

OVERVIEW

After the hour long closed session on Judge Doyle Square they move back to the budget. There was one late registrant, Robert Hansen of Fordem Ave in opposition and not wishing to speak.

All the budget materials are here.

The video starts about 3 hours in.

Dave Schimidicke gives background prior to the agency presentation.

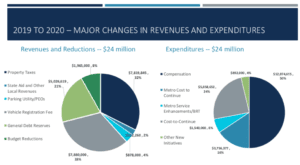

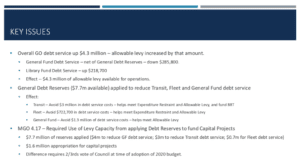

Big picture they have $24M above base that is happening from 2019 to 2020. This is in various funds, but they have some impact on the general fund and overall expenditures. A $7.8M increase in property taxes – allowed under levy limit combined with increase in GO debt service. He points about state aid and local revenues going up about 2%, about $1.4M increase in state aid, $800,000 decrease in our own source revenues (parking violations, building inspection fees, etc) He says there is also about $900,000 in police department being shifted to parking utility revenues. There is the vehicle registration fee that is set at a little under $7.9M so about 1/3 of the overall change from 2019 to 2020. We’re also applying general debt reserves, the re-offering premium when we sell our bonds, they used about $2.6M in the 2019 budget and they are using about $7.7M in the 2020 budget. That has an impact he will run through in a couple minutes. There is a little under $2M of reductions that are helping to spend other spending in the general fund budget.

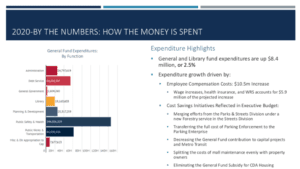

On the expenditure side, where are the dollars going, about half is going to compensation, that is a combination of the 3.25% pay increase for all staff, police and fire commission staff as well as all other city employees. It also includes health insurance cost increases, the retirement system, overtime funding, sufficient fringe benefits for the overtime costs. $3.7M of Metro Transit cost to continue plus the service enhancements laying the ground work for bus rapid transit is roughly 22% of the spending and they will get into how that works with the vehicle registration fee with the next slide. There is a cost to continue of about $8.5M (debt service, fleet rates, annualizing the costs of social service support funding for Tree Lane, things like that. The Pinney Library staffing.) Then there is other new initiatives, a little under $900,00 that includes teen librarian, the teen specialist at Warner Park Community Center, the various mental health initiatives within the police department.

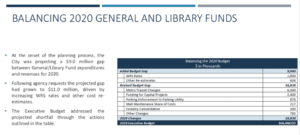

The talked at the outset of the budget about the gap of general and library funds of about $9M. That increased to almost $11M. They got information on WRS rates that added about $1M, most of it was in the police and fire commissioned staff. They closed the gap with the metro transit changes (a combination of the vehicle registration fee and the application of the premium, general debt reserves to pay debt service) which reduced the general fund support for transit. Part of the $9M forecasted that they would spend $4M on capital projects from the general fund and that has been reduced to $1.6M. The difference between 2019 and 2020 is about $1M that closed that gap. They talked about parking enforcement. The mall maintenance share of costs hasn’t been changed in almost 4 years, that would help save about $200,000. The consolidation of forestry into streets would save about $200,000 and then there are other changes and reductions to help balance the budget.

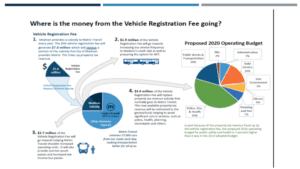

The $40 fee on an annual basis will raise about $7.8M. About 1.5M will go towards service enhancements, expanded bus service frequency on the south side as well as staff and dollars for studies related to the routes with Bus Rapid Transit building up some of the structure needed for that. It pays for Metro’s cost increases, pay increases, compensation and summer youth passes and increase low-income bus passes. The subsidy for Metro is being reduced by about $3.6M as a part of putting the vehicle registration fee into the metro fund. That means we can back those dollars away and that is helping fund the budget where we see increases in police and fire of 7% compared to the prior year and to fund the overall amounts described on the previous graph.

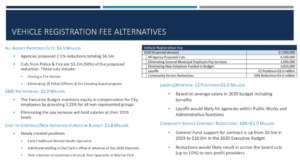

Alternatives to not having a wheel tax, if the dollars don’t come in, this is the menu items that are out there. The agencies were asked to provide 2.5% reductions, those totaled $6.5M. Half of that would come from police and fire. And those cuts would include closing a fire station and eliminating 18 police officers and the crossing guard program to meet the 2.5% target. Another option on the list would be to not provide the general municipal employee pay increase, the 3.25%, the cost of that is $2M. There is a number of cost to continue items, new initiatives (early childhood mental health specialist, clerk’s office staff for 2020 elections, teen librarian and teen specialist, police mental health), those and other reallocations or new allocations in the budget would be about $3.8M. Each million dollars of lay offs or attritions or reducing position authority around the city is about 12 positions. If it was applied across the board way it would disproportionately impact employees in public works and the administrative functions. If it would focused on community service contracts, each 10% reduction in community service contracts generates about $1M. That gives you a sense of without the vehicle registration fee what would have to happen in the budget to achieve a balanced budget.

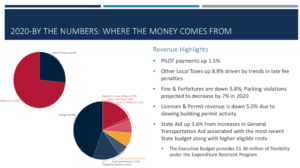

We are heavily dependent on the property tax, that is the nature of funding local government in WI and in Madison in particular. About 3/4 of the revenue comes from the property tax for the general library funds, the rest of our revenue is about 1/4 of that stream. When we look at that revenue stream, that 1/4 of the budget, a little less than half comes from state aid or intergovernmental revenues, we do get some fines and forfeitures, other local taxes (our share of room tax, license revenues, charges for services like ambulance conveyance fees), PILOT payments are primarily from our utilities and the water utility is the biggest element of that, and they are projected to go up about 1.5%. Other local taxes going up about 1.9%, is a small piece of the puzzle which is because of trends in late payments of property taxes and the penalties on that. Fines and forfeitures are down almost 6%, that continues a trend we have seen over the last couple years. With parking violations decreasing by about 7% in 2020. Again, that is tied to more technology being introduced into parking meters, they have less violations. They are getting better revenue collection in the parking utility vs fewer violation revenue going to the general fund. Licenses and permit revenue are down about 5%, again that is focused on building permits and that trend is slowing down. It’s not that we’re not having building permits issued, just not as many and not for as many large scale projects as we have seen in the past. Finally state aid if up 3.6%, much of that is a 10% increase in transportation aid in the most recent budget. When they look at the expenditure restraint program which we have to qualify for in order to receive $7M in state aid, the executive budget leaves about $1.36M of room under that. In the event that the actual costs exceed the budget in 2020.

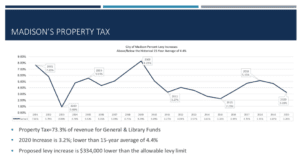

This shows the trend line of increases in the property taxes over the past 20 years. There is about a 3.2% in areas in 2020 (says 2019, they need to fix it), that is below the 15 year average. The proposed levy increase is about $334,000 lower than the allowable levy limit.

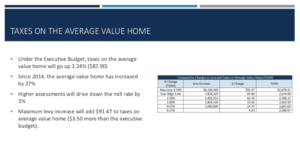

Taxes on the average value home will go up about 3.2% or a little under $88. Average home value has increased by about 27% since 2014. The reason we see that growth rate is because we are seeing the mill rate go down because the overall taxable value in the city is going up over 5%. So at that maximum levy increase we see the taxes on the average value home will be about $91 or $3.50 more than the executive budget. That shows the remaining room on the levy limit. The table shows where the taxes on the average value home would be at various levels of levy increase.

This shows where the dollars go.

- Administration is about $25M

- $54M for debt services

- $2.6M for general government, which includes the council, the mayor and municipal court

- $19M is the library

- $25M planning and development

- $144M – He says “Most of the budget is going into public safety, police and fire and health department.” (He doesn’t say the number out loud)

- $61M for public works and transportation

- and then miscellaneous appropriations a little under $8M.

Library and general fund expenditures are up by about $8.4M or 2.5% and that is driven by employee compensation costs and there are some cost savings included in the executive budget, they talked about merging forestry into the streets division, putting all the costs of parking enforcement onto the parking enterprise, decreasing the general contribution to capital projects as well as to Metro Transit because of the vehicle registration fee, changing the mall maintenance contribution and eliminating the general fund subsidy to CDA housing of about $175,000.

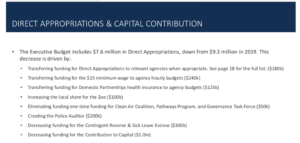

This is a list of appropriations that are under control of the Mayor and there have been a variety of things such as the subsidy to MadRep and support for the Martin Luther King Days celebration that are listed in direct appropriations. That is a change of about $1.7M decrease for a number of reasons. Some of the direct appropriations relate to work done in agencies (on page 18 of the budget, about $180,000), there had been money set aside to help move agencies to the $15 minimum wage, they reached that so that has been distributed in the agency budgets. Funding that had been identified for health insurance for domestic partnerships are also budgeted in the agency budgets. The city’s share of the Zoo operating costs are increased by $100,000 and reflects additional programming the county is doing, the city has to pay for 20% of the cost of operating the zoo after deducting the revenues of the zoo. There was some one time funding for the Clean Air Coalition, the Pathways Program and the Governor’s Task Force, about $50,000. There is an increase for creating a police auditor position, that is about $200,000. The contingent reserve and the sick leave escrow are money set aside to help support agency budgets for people who retire and get their sick leave paid out to them. And the contingent reserve was also reduced slightly, about $300,000 and that contribution to capital was reduced by $1M. These are all pieces of either putting dollars in the agency budget or helping to balance the budget.

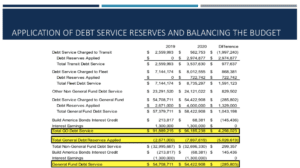

For debt service, there is a lot going on. Trying to balance the budget, avoid costs and so on. This is how they are applying the general debt reserves. They are the premium payment they get as a part of the debt issuance.

- The debt service charge to transit in terms of what is in the budget went from about $2.6M down to about $600,000 or a reduction of $2M. So that is helping to fund a portion of that reduction in the overall subsidy to transit and free up dollars for the operating budget. That is achieved by almost $3M of those debt reserves being applied, otherwise the debt service overall in transit is increasing by about $1M. That reflects the capital acquisition of buses and the work being done at the 1101 Bus Maintenance Facility and the first phase of paying the capital costs and debt service on that.

- Fleet debt service in the budget is going up about $868,000 but it would go up $1.6M because of the new fleet maintenance facility and the debt service on that and they are applying general debt reserves to pay that incremental debt service cost that would otherwise have to be coming out of the levy.

- Other non-general fund debt service (stormwater fund, other programs) is going up about $800,000.

- Debt service charge to the general fund is actually going down about $300,000 and that is being achieved by again more debt reserves being applied of about $1.3M.

- We get an interest credit on our Build America bonds that were issues about 10 years ago as a part of the recovery act, that is going down about $145,000.

- We’re assuming that interest earnings will stay the same about about $1.3 Million

Overall general obligation debt service is going up about $4.2M and our general debt reserves applied is going up $5M. He says that debt service going up a little over $4M, but because we are applying general debt reserves, the general fund amount is going down actually, rather than up. Library fund debt service is going up about $200,000. That means we have about $4.3 of allowable levy available for other parts of the budget. They achieve that by applying general debt reserves of $7.7M. We’re putting $3M into transit debt service, that means we can avoid $3M of debt service costs in the transit utility. That helps us meet expenditure restraint as well as free up allowable levy and helps fund bus rapid transit. Fleet we are avoiding about $700,000 of debt service costs and again that helps with expenditure restraint and allowable levy. We avoid $1.3M in debt service cost in the general fund which helps us meet the allowable levy.

In order to accomplish all of that there is a provision in the ordinance that we have to use that levy capacity when we apply debt reserves to pay debt service. An equal amount had to be appropriated to fund capital projects. We are not using all of it to pay for capital projects, we are appropriating $1.6M for capital projects, that difference is allowable under the ordinance but allows a 2/3 vote of the council at the time of the adoption of the 2020 budget. It’s the use of these general debt reserves to pay down debt service, there’s not an equal amount being applied to capital projects and that difference needs approval of the council with a separate vote.

ROOM TAX COMMISSION

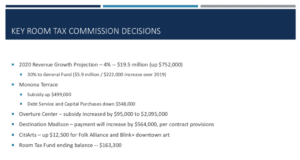

The room tax commission is the deciding body on 70% of the room taxes collected by the city, the other 30% goes to the general fund. The room tax commission decided on an estimated projection of 4% increase in the room tax, up about $750,000. That would mean about $222,000 increase in the amounts going to the general fund. That is built into the budget.

- Monona Terrace subsidy from the room tax is up about half a million. While the debt service for Monona Terrace and capital purchases are down about $550,000. So there is actually an overall reduction in the amount of room tax going to Monona Terrace.

- The subsidy for Overture was increased from $2M to $2,095,000 by the commission.

- Destination Madison receives about $5M a year and that is going up by half a million per their contract provisions.

- City Arts programs get about $12,500 requested by the mayor, that supports the Folk Alliance and Blink downtown art.

- There is an ending balance in the room tax fund of about $163,000.

QUESTIONS

Alder Keith Furman asks what the Room Tax Commission thought the increase was going to be for 2019 and did they hit that? In 2019 they assumed a 4% increase. They are trending a little under that but the big quarter is the 3rd quarter and they won’t know where that is at until November.

Alder Mike Verveer asks about general fund revenues – for inter-governmental revenues do they now have concrete numbers from the state for each of those or are there still line items that we are waiting for information? Schmidicke says the computer aid is set, the estimates of shared revenue they have, the general transportation aid just came out, so yes, they are pretty close with the executive budget and the information they have received so far. The only thing they don’t know is the payment for municipal services which is money from the state through the Department of Administration that pays for a portion of the costs of providing services to state and UW facilities.

Verveer asks about the estimate for PMS. Is that based not the understanding of the biennial budget act. Schmidicke says its based on the costs they submit every year like police and fire services and that is pro-rated and there is a formula. Based on the costs they submitted relative to last year, driven by mid-town police station and fire station 14, that means we will have a large cost base and it will be pro-rated, so we think it will go up, that was an estimate based on those costs. Verveer says “but we’ve never been fully funded”? Schmidicke says “no one has been fully funded”, we’re under 50%.

Verveer says there is a new provision for video service provider aide, is that included in any of the older line items. Will there be a budget amendment? Schmidicke says there will be a budget amendment to reduce the cable franchise fees (Verveer says its the bottom of page 11) will be reduced and then there will be a new intergovernmental aid for the video service providers. So that provision in the budget, the city levies a 5% gross receipts tax on cable franchise providers, the state adopted a law in the budge that limited the maximum amount to 4% and the state created an aid program to make municipalities whole for the difference. They just got the estimates from the Department of Revenue and they will include an amendment when you consider the operating budget amendments to make that correction. It’s revenue neutral.

Verveer also says they referred to the WRS numbers but do we have the ETF(?) health? Are they all firm and in the budge presentation? Schmidicke says yes.

They now move on to the budget presentations, which will be in part 2.