This is it! The new alders all ran for office saying they wanted to work on affordable housing. This is our big opportunity, $11 million dollars will be spent. Will it make a huge difference, or be more of the same old, same old? Will we see big radical meaningful changes?We’ll see. The two affordable housing funds are quite different, with different scoring, priorities, processes and requirements. The county does have big changes on tenant selection and landlord processes that include fines, the city’s remain a suggestion.

MEETINGS

Thursday, 5/2/19

11:00 AM Affordable Housing Development Fund Staff Team CCB – Room 421, Conference Room

– Public Comment

– 2019 RFP Draft

5:00 PM Community Development Block Grant Committee Madison Municipal Building 215 Martin Luther King Jr Blvd, Room 153

– Adopting the Triangle Monona Bay Neighborhood Plan as a Supplement to the City of Madison Comprehensive Plan and dissolving the Triangle and Monona Bay Ad-Hoc Neighborhood Plan Steering Committee.

– Approving submission of the City of Madison’s required 2019 Action Plan to the U.S. Department of Housing and Urban Development (HUD).

– Potential CDBG Funding for ConMarc, Inc-Balsam Road

– Affordable Housing Fund Request for Proposals

County Affordable Housing Fund RFP

The entire draft request for proposals is here. Highlights include:

- May 15th the RFP will be out

- Proposals due July 3, 2019

- Scoring/points are awarded as follows:

- Development Team Capabilities – 10%

- Project Description – 10%

- Location – 25%

- Solar Array – 5%

- Funding Leverage – 15%

- Tenant Selection – 10%

- Tenancy Addendum – 10%

- Housing First – 10%

- Supportive Services Plan – 5%

- The timing of this RFP is designed to allow developers to seek affordable housing tax credits in the 2019-2020 funding cycle. Once awards are determined, the County will allocate the funding for each project for a period of one year. If the project does not successfully secure its primary sources of financing within one year of the award, the funds will lapse.

- If the sources and uses for a project indicate that less than 40% of the developer fee has been deferred as a financing source, the amount requested will be reduced by the difference between the percentage of developer fee deferred and 40%.

- Total amount available $6 million

- The RFP is designed to forward the goal of Housing First. Housing First is an approach that centers on providing homeless people with housing quickly and then providing services as needed. What differentiates a Housing First approach from other strategies is that there is an immediate and primary focus on helping individuals and families quickly access and sustain permanent housing. This approach has the benefit of being consistent with what most people experiencing homelessness want and seek help to achieve. Housing First programs share critical elements:

- There is a focus on helping individuals and families access and sustain rental housing as quickly as possible and the housing is not time-limited; A variety of services are delivered primarily following a housing placement to promote housing stability and individual well-being;

- Such services are time-limited or long-term depending upon individual need;

- Housing is not contingent on compliance with services – instead, participants must comply with a standard lease agreement and are provided with the services and supports that are necessary to help them do so successfully.

- Targeted Populations – The RFP process is targeted to specific populations:

- A. Projects designed to serve the chronically homeless population, meaning those who are either: 1) an unaccompanied homeless individual with a disabling condition who has been continuously homeless for a year or more, or 2) an unaccompanied individual with a disabling condition who has had at least four episodes of homelessness in the past three years. Disabling conditions include mental illness and alcohol and drug addictions.

- B. Projects designed to serve the homeless veteran population.

- C. Very low-income families.

- D. Persons with arrest and conviction records.

- E. The elderly.

- F. Individuals with disabilities.

- This RFP is specifically dedicated to expanding the availability of housing units to serve the above populations through construction of new rental units. Below are other conditions/preferences the county seeks in RFP responses:

- Projects that meet the income, occupancy and rent restrictions of low income housing tax credits (LIHTC).

- Projects will have a long-term affordability requirement.

- Projects that include housing for households with income at or below 30% of County Median Income (CMI)

- Projects that are geographically located to maximize access to jobs, transit, schools and other key amenities.

- Projects that integrate supportive services in partnership with non-profit service providers.

- Projects that improve access to rental housing through generous tenant screening criteria.

- Projects that include 3+ bedroom units.

- The funds available through the AHDF are in the County’s Capital Budget. Statestatutes limit, to some extent, the use and flexibility of these capital funds. For projects that are within the jurisdiction of the Dane County Housing Authority (DCHA), areas of the County outside the Cities of Madison and Stoughton and the Village of DeForest, the County can use its capital funds to make a grant to the DCHA which will then make a grant or loan to the project developer for capital costs, such as land acquisition and construction.

- In areas outside the jurisdiction of the DCHA, the AHDF must be used by the County to purchase capital assets, such as land or a portion of a building, which can then be leased back to the project developer for project purposes.

- Projects that are located outside the City of Madison will receive 10 points. Projects located within the City of Madison that are more than one-half mile of any point indicated on the map shown as Attachment E will also receive 10 points. Project that are inside the City of Madison and are also within one-half mile of any point on the map will not receive location points. To facilitate this analysis, the points on the map are also listed in Attachment E. Respondents should indicate the parcel or parcel numbers of their project location as well as the address of the project.

- The County will contribute up to $50,000 for toward the cost of the installation of a PV array to serve the building.

- Fair Tenant Selection – See Attachment F. This attachment outlines specific tenant selection criteria and procedures. Respondents must indicate if they will agree to all of these elements. If a respondent agrees, then these elements will be included in final project documents. Those documents will provide for a $500 fine for any violations of these elements. Respondents that agree to these terms will receive the 10 points under evaluation criteria for Tenant Selection. Respondents who do not agree to these terms will not receive 0 points. Respondents not agreeing to the specified tenant selection criteria listed in the attachment should present their alternative tenant selection process that will be applied to the project.

- Tenancy Addendum – See Attachment G. This attachment outlines specific provisions of related to security deposits, late fees, termination of tenancy, parking and guest policies. Respondents must indicate if they will agree to all of these elements. If a respondent agrees, then these elements will be included in final project documents. Those documents will provide for a $500 fine for any violations of these elements. Respondents that agree to these terms will receive the 10 points under evaluation criteria for Tenant Selection. Respondents who do not agree to these terms will not receive those evaluation points.

- To further the goal of housing first, projects that designate a minimum of 12% of their units to the Coordinate Entry Systems Manager of the Homeless Services Consortium of Dane County (HSC) for individuals or families receiving case management services on the Community-wide Priority List for Housing maintained by the HSC and having those units filled by the Coordinated Entry Systems Manager of the HSC, in consultation with the projects property manager will receive an minimum of 5 points. Projects with more than 12% of units set aside to be filled from the Community-wide Priority List will receive up to 10 points. Respondents should clearly indicate if they agree to set aside any units to be filled from the Community-wide Priority list. If not, respondents should include a discussion of how their proposed projects forwards the goal of housing first.

- Supportive Services Plan – Provide a detailed description of how supportive services will be secured for the tenants of any property developed as part of this project. The description should detail the types of services that will be provided, any project partners who will be involved in providing those services and how the services will be funded. Responses should be specific in describing the partnership arrangements for any supportive services.

Map

Still being developed

Attachment F – Fair Tenant Selection Criteria

Respondents to this RFP that agree to the tenant selection criteria below will receive 10 points.

General Screening Process

The screening process applied to the project must not deny applicants based on the following:

a. Inability to meet a minimum income requirement if the applicant can demonstrate the ability to comply with the rent obligation based on a rental history of paying at an equivalent rent to income ratio for 12 months;

b. Lack of housing history;

c. Credit score;

d. Information on credit report that is disputed, in repayment, or unrelated to a past housing or utility (gas, electric, and water only) obligations.

e. Inability to meet financial obligations other than housing and utilities necessary for housing (gas, electric, water).

f. Owing money to a prior landlord or negative rent payment history if the tenant’s housing andutility costs were more than 50% of their monthly income.

g. Owing money to a prior landlord or negative rent or utility payment history if applicant does one of the following: (1) establishes a regular record of repayment of the obligation; 2) signs up for automatic payment of rent to the housing provider; or (3) obtains a representative payee.

h. Wisconsin Circuit Court Access records;

i. Criminal activity, except: (i) violent criminal activity within the last year resulting in a criminal conviction, and (ii) if the program or project is federally assisted, criminal activity for which federal law currently requires denial. (Violent criminal activity is defined in 24 C.F.R. 5.100 and means any criminal activity that has as one of its elements the use, attempted use, or threatened use of physical force substantial enough to cause, or be reasonably likely to cause, serious bodily injury or property damage.)

j. Membership in a class protected by Dane County fair housing ordinances and non- discrimination ordinances in the municipality where the project is located.

Denial Process

1) Prior to a denial based on a criminal record, the housing provider shall provide the applicant a copy of the criminal record and an opportunity to dispute the accuracy and relevance of the report, which is already required of HUD assisted housing providers. See 24 C.F.R. §982.553(d), which applies to public housing agencies administering the section 8 rent assistance program.

2) Prior to a denial based on a criminal record, the housing provider shall provide the applicant the opportunity to exclude the culpable family member as a condition of admission of the remaining family members.

3) Prior to a denial decision, the housing provider shall meet with the applicant to review their application and make an individualized determination of their eligibility, considering: (a) factorsidentified in the provider’s own screening policies, (b) if applicable, federal regulations, and (c) whether the applicant has a disability that relates to concerns with their eligibility and an exception to the admissions rules, policies, practices, and services is necessary as areasonable accommodation of the applicant’s disability. In making a denial decision, the housing provider shall consider all relevant circumstances such as the seriousness of the case, the extent of participation or culpability of individual family members, mitigating circumstances related to the disability of a family member, and the effects of denial on other family members who were not involved in the action or failure.

4) The property manager will base any denial on sufficient evidence. An arrest record or police incident report is not sufficient evidence. Uncorroborated hearsay is not sufficient evidence.

5) Denial notices shall include the following:a) The reason for denial with details sufficient for the applicant to prepare a defense, including: i) The action or inaction forming the basis for the denial,

ii) Who participated in the action or inaction,

iii) When the action or inaction was committed, andiv) The source(s) of information relied upon for the action or inaction.

b) Notice of the applicant’s right to a copy of their application file, which shall include allevidence upon which the denial decision was based.

c) Notice of the applicant’s right to copies of the property manager’s screening criteria.

d) Notice of the right to request an in-person hearing on the denial decision by making a written request for a hearing within 45 days.

e) Notice of the right to have an advocate present at the hearing and of the right to be represented by an attorney or other representative.

f) Notice of the right to present evidence in support of their application, including, but notlimited to evidence related to the applicant’s completion or participation in a rehabilitation program, behavioral health treatment, or other supportive services.

6) The if the applicant requests an in-person hearing, the hearing will be conducted by a person who was not involved in or consulted in making the decision to deny the application nor a subordinate of such a person so involved.

Attachment G – Tenancy Addendum

Respondents to this RFP that agree to include the following provisions within all tenant leases or as an addendum to all tenant leases will receive 10 points.

a. Security Deposits. The amount of a security deposit shall not be more than one month’s rent.

b. Late Fees and Other Fees. Late fees must be set forth in the rental agreement. Late fees shall not exceed 5% of the tenant’s portion of the monthly rent. Other penalty fees are prohibited. All other fees must be directly related to the cost for a specific amenity or service provided to the tenant and comply with all applicable laws.

c. Rights of Youth to Access Common Spaces. Youth under the age of 18 are allow to use and enjoy common areas without supervision.

d. Good Cause for Termination. A tenancy may not be terminated during or at the end of the lease unless there is good cause. Good cause is defined as a serious violation of the lease or repeated minor violations of the lease. Repeated means a pattern of minor violations, not isolated incidents. Termination notices and procedures shall comply with Chapter 704 of Wisconsin Statutes and federal law, when applicable. Written notice is required for non-renewal and shall include the specific grounds for non-renewal and the right of the tenant to request a meeting to discuss the non-renewal with the landlord or landlord’s property management agent within fourteen (14) days of the notice. If requested, the landlord or property management agent will meet with the tenant to discuss the non-renewal, allow the tenant to respond to the alleged grounds for non-renewal, and pursue a mutually acceptable resolution.

e. Reasonable Guest Rules. Tenants have the right to have guests. In the event the property management establishes rules related to guests, they must be reasonable. Unreasonable rules include, but are not limited to the following: (1) Prior authorization of guests by the property management, unless the guest is staying for an extended period of time (e.g. more than 2 weeks); (2) Prohibition on overnight guests; (3) Requiring that the resident be with the guest at all times on the property. (4) Requiring guests to show ID unless requested by the tenant. (5) Treating caregivers, whether caring for a child or children, or an adult with disabilities, as guests.

Landlord may ban a person who is not a tenant from the rental premises if the person has committed violent criminal activity or drug related criminal activity at rental premises. No person shall be banned from the rental premises without the consent of the tenant unless the following have taken place:

(1) A notice of the ban is issued to the tenant stating the:

(a) name of the person banned,

(b) grounds for the ban including, (i) the specific facts detailing the activity resulting in the ban; (ii) the source of the information relied upon in making the ban decision; and (iii) a copy of any criminal record reviewed when making the ban decision; and

(c) the right of the tenant to have a meeting to dispute the proposed ban, discuss alternatives to the ban, and address any unintended consequences of the proposed ban.

(2) If requested, a hearing on the ban has taken place to provide the tenant an opportunity to dispute the proposed ban, discuss alternatives of the ban, and address any unintended consequences of the proposed ban.

A tenant may not invite or allow a banned person as a guest on the premises, provided the Landlord has followed the proper procedure and given notice to Tenant as set forth herein.

A tenant who violates the guest policy may be given a written warning detailing the facts of the alleged violation. The written warning shall detail the violation, and warn the tenant that repeated violations may result in termination of tenancy. Tenants that repeatedly violate the guest policy, (e.g. three (3) or more violations within a twelve (12) month period) may be issued a notice of termination in accordance with state and federal law.

Nothing in this policy limits a person’s right to pursue a civil order for protection against another individual.

f. Parking Policies. Parking policies and practices must comply with applicable laws. Vehicles shall not be towed to a location that is more than 6 miles from the rental premises, is not a towing company with a tow location available within 6 miles.

City Affordable Housing Fund RFP

The entire draft request for proposals is here. Highlights include:

- Title = Affordable Housing Fund: Developers Seeking 2020 WHEDA Tax Credits for Rental Housing Development

- Timeline

- May XX, 2019 – Release of RFP

- 12:00 p.m. NOON (CST) June 27, 2019 – DEADLINE FOR SUBMISSION OF PROPOSALS

- Week of July 22, 2019 – CDD requests additional/clarifying information from applicants, if necessary.

- Week of August 5, 2019 – Applicants respond to request for additional/clarifying information

- Week of August 12, 2019 – Applicant Presentations to Staff

- September 5, 2019 – Applicant Presentations to CDBG Committee

- October 3, 2019 – CDBG Committee Recommendations

- October 7, 2019 – Finance Committee Recommendations

- October 15, 2019 – Common Council Approval

- November 2019 – Commitment Letter (Notification of Award)

- Late 2020 – Mid 2021 – Anticipated contract effective date(s)

- Scoring

- Overall Quality and Responsiveness – 40 points

- Proposed Site – 25 points

- Financial Feasibility and Leverage – 20 points

- Capacity, Experience and Qualifications of Development Team – 15 points

- Alder and Neighborhood Notification & Meetings – 10 points

- The City of Madison Community Development Division (CDD) is seeking to improve the competiveness of development proposals submitted to WHEDA and maximize the receipt of tax credits for projects in Madison through proposals from qualified developers that seek to accomplish the following three objectives:

-

- Increase the supply of safe, quality, affordable rental housing.

- Preserve existing income- and rent-restricted rental housing to ensure long-term affordability and sustainability.

- Improve the existing rental housing stock in targeted neighborhoods

through acquisition/rehab to create long-term affordability and sustainability.

-

- The CDD anticipates having approximately $5 million available from the City’s Affordable Housing Fund to support 3-4 proposals through this process.

- The goal of the Affordable Housing Initiative is to improve the competiveness of development proposals submitted to WHEDA and maximize the receipt of tax credits for projects in Madison that seek to accomplish the following three objectives:

- Increase the supply of safe, quality, affordable rental housing.

- Preserve existing income- and rent-restricted rental housing to ensure long-term affordability and sustainability.

- Improve the existing rental housing stock in targeted neighborhoods through acquisition/rehab to create long-term affordability and sustainability.

In addition to these primary objectives, the Affordable Housing Initiative aims to:

-

- Achieve a wider dispersion of affordable rental housing throughout the city and discourage development of additional supply of income- and rent-restricted units in areas with high concentrations of poverty and/or assisted housing.

- Incentivize new development in areas of the city with strong connections with or proximity to key amenities such as employment opportunities, public transit, a full service grocery store, health facilities, schools, parks, and other basic amenities.

- Align CDD-assisted development and property management practices with the City’s Racial Equity and Social Justice Initiative through inclusive and culturally-sensitive marketing.

- The City’s primary objective is to add at least 200 units to the supply of affordable rental housing in Madison.

- Assistance offered from City Affordable Housing Funds will be contingent upon their authorization during the 2019 Budget process, which concludes in November of 2019. All funding awards offered to a project by the City are made contingent upon an applicant’s receipt of LIHTC for that project, as well as the applicant’s ability to secure other financing necessary for the project, and land use and permit approvals.

- Funds awarded through this RFP are expected to be secured by a Loan Agreement by December 31, 2021. Payment schedule will be negotiated at point of contract with 10% of funds reserved until project completion.

- CDD anticipates offering gap financing awards that range from $15,000-$40,000 per unit of affordable housing. The amount of subsidy offered will reflect the extent to which proposals match the City’s overall goals, objectives, and preferences as described in this RFP; the extent to which all other available financing sources are pursued; and the availability of funds.

- CDD anticipates that at least 50% of the funds offered to any project will be provided in the form of a 30-year loan, at 0% interest, payable upon the earliest of the sale, transfer, or change in use of the property. Repayment will be based on a percent of the restricted rent appraised value after rehabilitation or construction, derived from the amount of CDD- administered funds invested in the project or the amount of the loan, whichever is greater.

- CDD further anticipates that up to 50% of the funds offered will be provided in the form of a 16-year term loan, amortized over 30 years. The interest rate will be set at 2.75% or the annual long-term Applicable Federal Rate, whichever is lower. Annual payments will commence on April 1st of the year following final disbursement of funds, contingent upon sufficient cash flow to support the project. In the event that cash flow is insufficient to pay all or a portion of the annual payment, the balance of the loan must be repaid at the end of the 16-year term. Funds awarded under this RFP will be loaned directly to the project’s ownership entity (e.g., single purpose LLC).

- The City will secure its funding with promissory notes and a mortgage in the form of non- recourse loans. Applicants offered financial support will be required to enter into a 30-year Land Use Restriction Agreement, recorded in first position following the first mortgage for the period of affordability.

- The City will require the recipient of its funds to submit detailed compliance reports and other periodic reports on the project during the period of affordability. Due dates and specific requirements will be established within the Loan Agreement. The City reserves the right to schedule site visits to verify compliance with the terms of the City agreement.

- In addition to direct subsidies offered as part of this RFP, applicants may also qualify for a waiver from payment of Park Impact Fees for development of low-cost rental housing units. A low-cost unit is defined as one reserved for households with incomes less than or equal to 60% AMI and for which rents are restricted to amounts not greater than 30% of income for a household at 60% AMI with a land use restricted period of at least 30 years.

- Requirements – The CDD has identified the following conditions of eligibility:

- Applicant must seek 2020 LIHTCs and meet the corresponding income, occupancy, and rent restrictions.

- The entity applying for City funds must have an ownership interest in the development.

- Applicant must demonstrate site control at the time of application, unless the site is already owned or controlled by the City or the Community Development Authority.

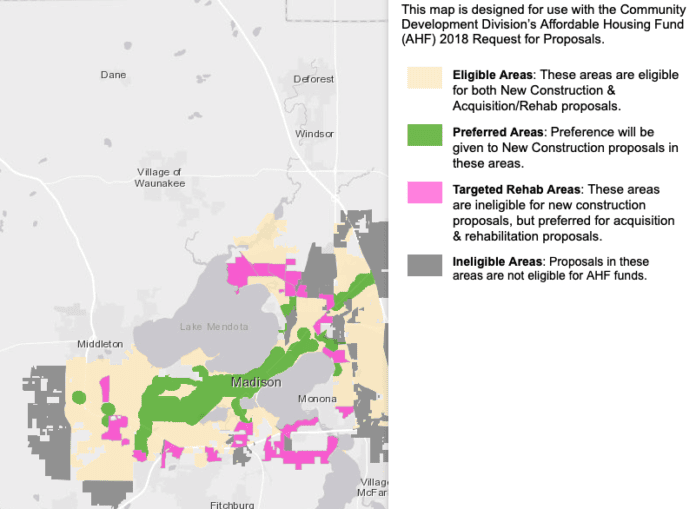

- Proposed sites for new construction must be located in an Eligible or Preferred Area as identified on the map. However, an acquisition/rehab development may be proposed at any location within the City of Madison, except areas designated as Ineligible. Refer to Section 1.5 above or the map listed as Attachment A.

- Proposals must demonstrate strong connections with or proximity to key amenities such as employment opportunities, public transit, a full service grocery store, health facilities, schools, parks, and other basic amenities.

- At least 15% of the proposed affordable units must be reserved for households with incomes at or below 30% AMI and those units must be distributed proportionately across proposed unit sizes (e.g., one, two, and three or more bedroom units).

- At least 20% of the proposed total units must be designated as supportive housing units and make adequate supportive services available for the selected target populations.

- Any proposal serving households with incomes at or below 30% AMI must have adequate supportive services available to meet the needs of those households.

- Proposals offered City funds will be expected to apply, or have applied, to the Federal Home Loan Bank’s Affordable Housing Program.

- Proposals must engage in the Pre- and Post-Application Processes pertaining to land use entitlements and neighborhood engagement described in Section 2 below.

- Proposals seeking tax credits through the WHEDA Supportive Housing set-aside will not be considered under this RFP.

- Preferences – In addition to the conditions of eligibility listed above, preference will be given to:

- New construction proposals with a site located in a Preferred Area as identified on the map listed as Attachment A.

- Acquisition/rehab proposals with a site located in a Targeted Rehab Area as identified on the map listed as Attachment A.

- Proposals from a non-profit entity that assumes the roles of both Developer and Owner or a partnership where the non-profit has a majority ownership interest in the property and/or a General Partner Purchase Option, Right of First Refusal, or a controlling interest in the ownership entity.

- Proposals in which more than 20% of the proposed affordable units contain three or more bedrooms.

- Proposals in which more than 20% of the proposed affordable units are made available for households with incomes at or below 30% AMI representing a proportional mix across proposed unit sizes (e.g., one, two, and three or more bedroom units).

- Proposals that reflect an integrated supportive housing approach, described below, in addition to meeting the supportive housing requirements outlined in WHEDA’s QAP and Appendix S targeting veterans and/or people with disabilities.

- Proposals that leverage the use of all available resources including the deferment of the maximum amount of developer fee feasible.

- Proposals that offer repayment of the amortized interest loan beginning in Year 1 simultaneously with repayment of the deferred developer fee.

- Proposals that provide a non-smoking environment throughout the property.

- Proposals that include in-unit internet service at low or no cost to residents.

- Proposals for multifamily developments that include a dedicated year-round indoor play space and/or outdoor playground on the premises.

- Proposals that present a Tenant Selection Plan (TSP) that embraces the CDD’s TSP Best Practices outlined in Attachment B-1.

- Proposals that present an Affirmative Marketing Plan (AMP) that embraces the CDD’s AMP Best Practices outlined in Attachment B-2.

- Preference will be given to proposals that incorporate one or more of the following approaches to supportive service partnerships:1. Target supportive housing units to one or more of the following population(s): a. Individuals and/or families experiencing homelessness selected from the applicable Community-wide Priority List and partner with a local Homeless Services Consortium service provider listed on Attachment B;

b. Formerly homeless families occupying permanent supportive housing units who are deemed by their service provider to no longer require intensive supportive services and partner with a local Homeless Services Consortium service provider listed on Attachment B.

c. Other Supportive Service Target Populations and related supportive service partnerships which may include:

i. Previously incarcerated individuals re-entering the community; and/or

ii. Other target populations that meets an identified community need.- Contribute meaningful financial support for supportive services provided through local service partner(s) experienced in serving the target population. Level of support, intensity, and location of the services (i.e., on- or off-site) will depend on the needs of the target population(s).

- Leverage additional and adequate non-City funded supportive services dollars.

- Demonstrate extensive consultation and coordination of the collaborative partnership between the development, property management, and the supportive services teams. This includes developing a supportive services plan describing, in detail, the design of services made available to the target population(s); planning for a unit mix that will best accommodate the targeted population(s); having pre- and post-initial lease up referral processes designed to screen-in prospective tenants from these target population(s); and utilizing alternative, flexible tenant screening criteria for prospective tenants who are connected to and/or will have improved access to supportive services.

Map

The 2019 Affordable Housing Targeted Area Map is included in this RFP as Attachment A. A larger version of the map may be printed from the link at: Community Development Division Funding Opportunities Website. A searchable version of the map where proposers can enter specific addresses may be found on the City’s Open Data Portal. The City of Madison Planning Division also maintains a searchable version of the City’s Zoning Map on its website.

- New Construction of Rental Housing – Must be located in the Eligible or Preferred Areas

- Acquisition &/or Rehab of Rental Housing – May be citywide, but preferred in Targeted Rehab Areas

- Any project that will serve populations that may need intensive case management or ongoing support services – Must be located in Eligible or Preferred Areas.

Tenant Selection Plan Best Practices – City of Madison Affordable Housing Initiative

The Affordable Housing Fund (AHF) Loan Agreement requires a tenant or resident selection plan and adherence to all state, local, and federal fair housing requirements.

Below is a set of best practices that may assist housing developers and property managers in drafting a Tenant Selection Plan (TSP). These best practices serve to align the City’s AHF goals with those of the project and to ensure Madison residents have reduced barriers to fair housing choice. They are not intended to be a complete or exhaustive list. In creating your project’s Tenant Selection Plan, housing developers and property managers should consult with your attorney to ensure that your plan complies with all applicable laws and regulations, program requirements, and the Fair Housing Act.

The TSP should clearly identify the project’s criteria regarding the following categories:

- Income criteria, including providing clear information on minimum and maximum income requirements of applicants and the processes and criteria used to evaluate applications. Identify the unit mix, i.e., the quantity of housing units that are available for rent at each level of income-restriction (e.g. 30% of the Area Median Income, 50% of the Area Median Income, 60% of the Area Median Income). The TSP should also indicate the rent structure that identifies the rental rates of units by bedroom size and income distribution.

- Occupancy criteria, including defining the minimum number of persons allowed to occupy each unit in the project, subject to local, state, and federal laws. Each unit should be occupied by a minimum of one person per bedroom at the time of occupancy.

- Credit score and/or report. The TSP, marketing, and application materials should include a section noting whether or not a credit report will be ordered. The housing provider must provide a notice to applicants if adverse action is taken based on information obtained from the credit report.

- Landlord or housing history, including eviction judgment.

- Waitlist process and waitlist preference criteria, if applicable. The TSP should note that apartments are rented on a first come, first served basis.

- Notice of denial, which includes a written explanation of the TSP criteria the applicant failed to meet. The notice of denial should inform applicants how to seek an appeal of the housing provider’s decision.

- Compliance with the Violence Against Women Act (VAWA), which provides that an applicant may not be denied admission on the basis that the applicant is or has been a victim of domestic violence, dating violence, sexual assault, or stalking, if the applicant or tenant otherwise qualifies for admission.

- Tenant selection and application criteria for supportive housing units.

- Criminal and felony convictions, including defining the number of years that will be considered in a criminal background search. A housing provider’s TSP should clearly define what information will be collected for the use of screening an applicant’s criminal history:

- It is unlawful for a housing provider to reject applicants solely based on arrest records (without conviction)

- Housing providers should distinguish between convictions for criminal conduct that indicates a demonstrable risk to resident safety and/or property and criminal conduct that does not.

- Screening policies should take into account the nature and severity of a conviction and the amount of time that has passed since the criminal conduct occurred

- Housing providers should take into account evidence that the individual has maintained a good tenant history before and/or after the criminal conduct occurred.

• Preferences:

The project should establish preferences that conform to preferences identified in the development’s approved LIHTC application submitted to WHEDA, and in the signed Supportive Services Agreement, as applicable. The TSP should identify the age-restriction, or lack thereof, of tenancy for the project. Acceptable age-restrictions may include “family” housing for units without an age-restriction; “active-adult” or “senior” housing for units restricted to households with at least one member aged 55 and above; and “elderly” housing for units restricted to households aged 62 and above.

The TSP should establish resident preferences that do not diminish or obstruct the Project’s fair housing obligations. Both existing tenant preferences and new tenant preferences should be outlined in the TSP. The TSP should identify the populations targeted to lease supportive services units in the Project, if applicable. The Project’s waitlist must indicate if certain tenant populations will be given a higher priority for units than others.

The TSP should explicitly state that applicants would not be denied solely due to:

- A lack of housing history;

- A low credit score, provided that the applicant has a cosigner and/or is enrolled in a credit repair program;

- Information on a credit report that is or has been formally disputed, in repayment, or unrelated to a past housing or housing utility obligation;

- The applicant owing money to a prior landlord for rent or damages, or to a utility company, provided the applicant has entered into a payment arrangement with the debtor and is current on the repayment arrangement;

The City of Madison and the U.S. Department of Housing and Urban Development (HUD) stress the importance of applying TSP standards consistently to all applicants.

Affirmative Marketing Plan Best Practices City of Madison Affordable Housing Initiative

The Affordable Housing Fund (AHF), HOME Investment Partnerships Program (HOME), and Community Development Block Grant (CDBG) Loan Agreements require an Affirmative Marketing Plan and adherence to all state, local, and federal fair housing requirements.

Below is a set of best practices that may assist housing developers and property managers in drafting an Affirmative Marketing Plan (AMP). These best practices serve to align the City’s goals with those of the project and to ensure Madison residents have reduced barriers to fair housing choice. They are not intended to be a complete or exhaustive list. In creating your project’s Affirmative Marketing Plan, housing developers and property managers should consult with your attorney to ensure that your plan complies with all applicable laws and regulations, program requirements, and the Fair Housing Act.

The AMP should clearly identify the project’s criteria regarding the following categories:

- Applicant and Project Identification, the plan should specify the approximate start date of marketing activities to groups targeted for special outreach and the expected date of initial occupancy.

- Targeted Outreach, the plan should identify the demographic groups that are “least likely to apply” for this housing without special outreach. In determining which groups should be identified, housing providers should consider the rental rate of the housing, the racial/ethnic composition of the neighborhood in which the property is located, and the population of the broader housing market area.

- The plan should describe the marketing efforts anticipated to be used to attract the demographics identified as least likely to apply, as well as all segments of the eligible population. These efforts could include the type of media used to advertise the development (including the names of publications and websites to be used); the duration that the marketing effort will be published in the newspaper or run on the radio; and the identity of the intended audience of each marketing effort.

- Specific community organizations and contacts should also be identified when describing targeted outreach, with a special emphasis placed on those agencies able to influence populations identified as least likely to apply. City staff can assist housing providers in identifying points of contact and relevant listservs, if necessary. Examples of listservs that should receive housing vacancy lists include: Homeless Services Consortium and the City’s Neighborhood Resource Teams.

- Pursuant to the Loan Agreement, marketing materials will be reviewed by the City of Madison Community Development Division. Any marketing materials that depict graphics or renderings of people should be inclusive, diverse, culturally-sensitive and representative of the demographics of target populations identified in the AMP as well as the supportive service population(s) described in the tenant selection plan, if applicable.

• Future and Continued Marketing Efforts, the plan should include a statement or description of how the housing provider will continue affirmative marketing efforts after initial lease-up is complete to maintain occupancy goals. The property must use the Equal Housing Opportunity logo on all notices, lease documents, and marketing materials, and the Fair Housing poster must be prominently displayed in the leasing office, including any temporary spaces that may be used during lease up.

• Staff Experience, the plan should indicate the experience, training, and certification(s), if any, held by staff that will be involved in marketing and lease-up of the property. The AMP should mention that a hard copy of the plan, and any other written materials regarding fair housing laws, should be available on request in the leasing office.

The project should make note of efforts that conform to preferences identified in the development’s approved LIHTC application submitted to WHEDA, as applicable. The AMP should identify the age- restriction, or lack thereof, of tenancy for the project. Acceptable age-restrictions may include “family” housing for units without an age-restriction; “active-adult” or “senior” housing for units restricted to households with at least one member aged 55 and above; and “elderly” housing for units restricted to households aged 62 and above.

The AMP should describe demographics least likely to apply in a manner that does not diminish or obstruct the Project’s fair housing obligations. The AMP should identify the populations targeted to lease supportive services units in the Project, if applicable. The Project’s waitlist must indicate if certain tenant populations will be given a higher priority for units than others.

While not explicitly required, the City of Madison will also accept a HUD template Affirmative Fair Housing Marketing Plan (HUD Form 92243-PRA) that incorporates the above best practices. The City of Madison and the U.S. Department of Housing and Urban Development (HUD) stress the importance of implementing the AMP consistently during leasing and throughout the lease-up process.