Well, that didn’t work out so well now did it? What appeared to be a money grab in 2017 is now a cut in funding.

HISTORY

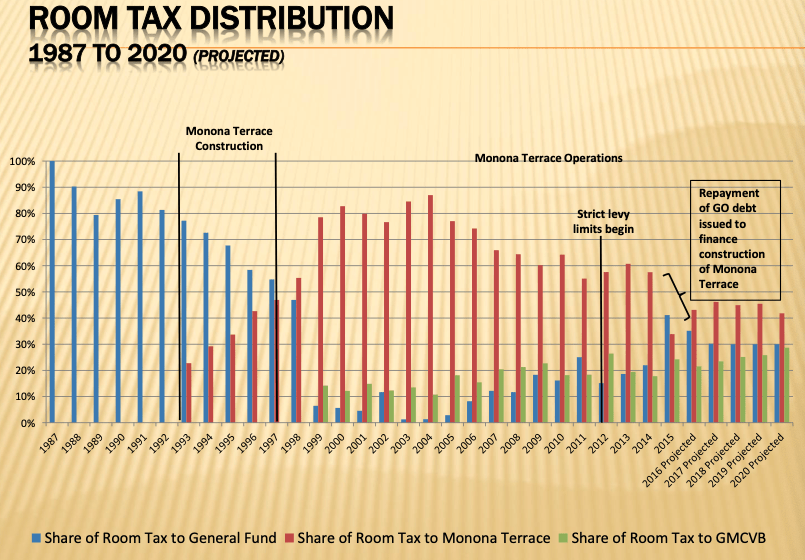

In the 2015-2017 Budget the State legislature changed the rules on how room taxes could be spent. Prior to the change, Madison could keep 70% of the room taxes for general purposes and it was allocated through the Madison budget. After the law change, the Room Tax Commission makes the decisions about where the money goes and 70% of the Room Tax has to go towards tourism. Now the City of Madison only keeps 30% of the Room Tax for its budget. Functionally the general fund was getting 37% of the funds and had to drop to 30%. At the time, this was a big win for the Greater Madison Convention and Visitors Bureau because less and less money was needed for Monona Terrace and they were expecting increases, and they got them – see the green lines below where their share increases.

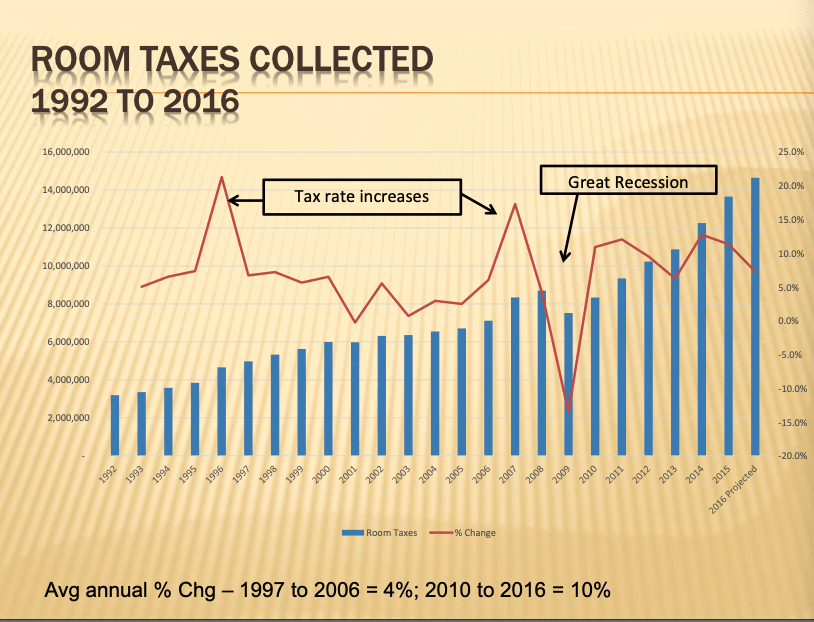

The room taxes had been steadily rising, and even the “Great Recession” didn’t make much of a dent.

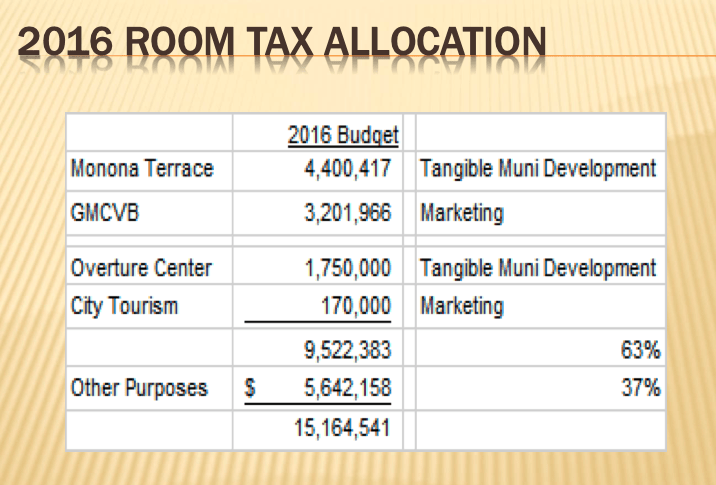

At the time (2016), Greater Madison Convention and Visitor’s Bureau was getting $3,201,966 in funds from the city, this year they were expecting $5,464,037, but now they will be getting less than they got in 2016.

The city shifted some if its funding – Zoo, Olbrich, Sister Cities etc to the Room Tax in addition to the above. But things have changed . . . and the Finance Committee and Council will be discussing changing the contract in the near future.

RESOLUTION

Fiscal Note

The proposed resolution authorizes an amendment to the purchase of services agreement between the City of Madison and the Greater Madison Convention and Visitors Bureau pursuant to the 2020 budget amendments adopted by the Room Tax Commission. The overall reduction from the Room Tax Commission 2020 Adopted Budget is approximately $2,464,037 from $5,464,037 to $3,000,000.

Title

A Resolution authorizing an Amendment to the Purchases of Services Agreement between the City and the Greater Madison Convention and Visitors Bureau.

Body

WHEREAS, the Greater Madison Convention and Visitors Bureau (the “Bureau”) provides tourism marketing services and seeks to attract new destination businesses, visitors, conventions, events and trade shows to the greater Madison area; and

WHEREAS, the City, through the Monona Terrace Community and Convention Center has contracted for such services under the Purchases of Services Agreement with the Bureau, dated November 27, 2017, and

WHEREAS, the revenue funding for the Agreement comes from the room tax on the furnishing of rooms or lodging, and

WHEREAS, the City of Madison Finance Department staff, based on preliminary national forecasts of hotel industry revenues, estimated that 2020 Room Tax revenue will be reduced by at least 50% from actual fiscal year 2019 Room Tax collections, and

WHEREAS, at its July 7, 2020 meeting, in response to the estimated reduction in Room Tax revenue, the Room Tax Commission adopted an amendment to its 2020 Adopted Room Tax Budget, which reduced the budget appropriation to each entity and agency supported by the Room Tax Commission, including the Bureau, and

WHEREAS, under the Commission’s amended Room Tax Budget, payment to the Bureau for General Destination Marketing is reduced to $2,950,000 and payment for the Event Booking Assistance is reduced to $50,000, including the $5000 administrative fee, and

WHEREAS, the City and the Bureau have agreed upon an Amendment to the Purchases of Services Agreement between the parties, which reduces payments by the City to the Bureau, as provided in the amended 2020 Room Tax Commission Room Tax Budget,

NOW THEREFORE BE IT RESOLVED, that the Common Council hereby authorizes the Mayor and Clerk to sign on behalf of the City of Madison, an Amendment to the Purchases of Services Agreement with the Greater Madison Convention and Visitors Bureau, as described above.

AMENDMENT

Amendment to Purchases of Services Agreement

Whereas, because of the reduction in estimated Room Taxes due to the economic impact of the public health emergency related to the COVID-19 Pandemic, the Room Tax Commission met on July 7, 2020, to consider revisions to the 2020 Adopted Room Tax Commission Budget, and

Whereas, the City of Madison Finance Department staff, based upon preliminary national forecasts of hotel industry revenues, estimated that that Room Tax revenue would be reduced by at least 50% from actual fiscal year 2019 collections for fiscal year 2020, and

Whereas, at its July 7, 2020 meeting, in response to the reduction in estimated Room Taxes, the Room Tax Commission adopted an Amendment to its 2020 Adopted Room Tax Budget which reduced the budget appropriation to each agency and entity supported by the Room Tax Commission, and,

Whereas, the City of Madison, Wisconsin, a municipal corporation (“the City”) and the Greater Madison Convention and Visitors Bureau, a Wisconsin non stock corporation, (the “Bureau”) are parties to the Purchase of Services Agreement, dated November 27, 2017, including Exhibit A thereto (the “Agreement”) which has been amended by the parties on an annual basis, under which the Bureau provides tourism marketing services for conventions, conferences, events and tourism travel to the City,

Whereas, Section 4 of the agreement allows the City to reduce payments to the Bureau in the event that revenue growth is projected to increase 0% or less over the prior year or if the Room Tax Fund is projected to have a deficit in any year of the term of the Agreement after the application of all reserves. The revenue growth and fund condition forecasts must be accepted by action of the Room Tax Commission prior to the City exercising this provision.

Now, Therefore, pursuant to Section 16 of the Agreement, the parties to the Purchase of Services Agreement mutually agree to amend the Agreement, including Exhibit A the Description of Program Goals and Compensation 2020 and Attachment A to Exhibit A the Bureau 2020 – 2022 Strategic Plan, as follows:

1. Payment for General Destination Marketing, which was $5,264,037, based on actual 2019 room tax collections, is amended to not more than $2,950,000.

2. The Event Booking Assistance Subsidy, which was estimated to have a value of up to $200,000, is amended to not more than $50,000, including the $5,000 administrative fee.

Monthly payments for the remainder of fiscal year shall be adjusted so that the total payments for General Destination Marketing for fiscal year 2020 shall total up to $2,950,000 for the entire fiscal year. The Program Goals in Exhibit A shall not be applicable for payments made for fiscal year 2020.

In Witness Thereof, the Parties have signed this Amendment.